Understanding the Basics of Wharfage

Wharfage refers to the fees charged to ships or vessels for utilizing port facilities such as wharfs, docks, and other maritime infrastructure. These fees, imposed by port authorities or wharf owners, are essential for funding the maintenance and operation of port facilities. The cost of wharfage varies based on multiple factors, including the type of cargo, vessel size, and duration of stay. Understanding wharfage is crucial for stakeholders in the shipping industry to effectively manage logistics and operational expenses.

What is Wharfage and Why is it Important?

Wharfage is a fundamental aspect of the shipping industry, directly impacting the overall cost of transporting goods. These fees are levied on shipping companies or cargo owners and are used to cover expenses associated with maintaining and operating port facilities. This encompasses costs related to dredging, dock maintenance, breakwater construction, security measures, and other essential services that ensure the smooth functioning of ports.

Without wharfage fees, the financial burden of port maintenance would fall on taxpayers, rendering port operations unsustainable. Additionally, wharfage fees promote a competitive environment within the shipping industry by ensuring that all companies contribute fairly to the upkeep of port infrastructure. This leveling of the playing field enables smaller shipping companies to compete with larger counterparts, fostering a more competitive and diverse market.

According to the World Bank, efficient port operations are critical for global trade, with ports handling over 80% of the world’s merchandise trade by volume.

The Evolution of Wharfage Fees: A Historical Overview

The concept of wharfage fees dates back to ancient civilizations, where they were instrumental in funding the construction and maintenance of port facilities. In ancient Rome, for example, wharf fees were a primary source of income for port maintenance and expansion.

In modern times, the landscape of wharfage fees has undergone significant transformation. The past decade has seen a shift towards privatization and the integration of market-driven forces in determining wharfage rates. This change has been propelled by increasing global trade competition, pushing ports worldwide to enhance efficiency and cost-effectiveness. Privatization offers greater flexibility in setting wharfage rates, allowing private entities to innovate and optimize operations without the constraints typically associated with public port authorities.

Recent trends indicate that ports employing dynamic pricing models for wharfage can adapt more swiftly to market demands, as highlighted in the Port Technology International report.

Different Types of Wharfage and Their Usage

Wharfage fees come in various forms, tailored to different aspects of port usage:

- By Weight or Volume: Charges based on the weight or volume of the cargo being handled. Ports dealing with bulk commodities like coal or grain often adopt this model.

- By Value: Fees calculated based on the monetary value of the goods, typically applied to high-value items like electronics or luxury goods.

- Additional Services: Costs for utilizing extra services such as cranes, weighbridges, or storage facilities. These services enhance the efficiency of cargo handling but incur extra charges.

- Incentives and Discounts: Some ports offer reduced wharfage fees for specific types of cargo or shipping companies, encouraging business growth and loyalty.

It's important to note that wharfage fees can significantly vary depending on the port’s location and the nature of the cargo. For instance, ports handling large quantities of bulk goods may have lower fees compared to those managing high-value or specialized cargo requiring tailored handling solutions.

According to the Baltic and International Maritime Council (BIMCO), diverse fee structures allow ports to cater to a wide range of shipping needs, enhancing overall port attractiveness.

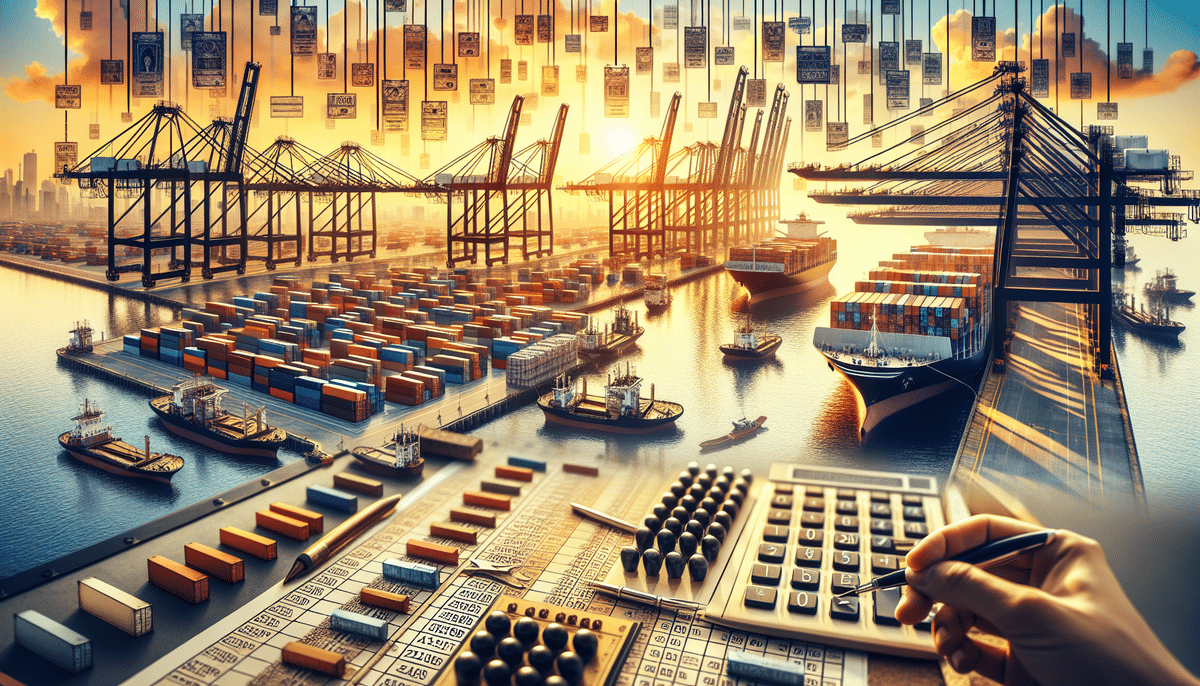

Calculating Wharfage Fees: A Comprehensive Guide

Calculating wharfage fees involves a multifaceted approach, considering several factors that influence the final cost:

- Type of Cargo: Different goods may incur varying fees based on their handling requirements and value.

- Vessel Size and Weight: Larger or heavier vessels typically attract higher wharfage fees due to the increased space and resources they consume.

- Duration of Stay: Extended port stays can lead to higher fees, motivating efficient loading and unloading processes.

- Additional Services: Utilization of specialized equipment or services adds to the overall wharfage cost.

- Environmental Considerations: Ports may incorporate environmental fees to support sustainable practices, such as emission controls and waste management.

Wharfage fees can differ significantly between ports and regions. For example, a port situated in a major metropolitan area may charge higher fees due to increased demand and operational costs. Conversely, ports in less congested areas might offer more competitive rates to attract business.

Research conducted by the Journal of Commerce highlights the importance of understanding diverse fee structures to optimize shipping costs and operational efficiency.

Factors That Affect Wharfage Rates and Charges

Several factors influence the determination of wharfage rates, including:

- Market Demand: High demand for port services can drive up wharfage fees, while lower demand may lead to reduced rates.

- Port Location and Accessibility: Ports that are strategically located with excellent accessibility often command higher fees due to their attractiveness to shipping lines.

- Local Labor Costs: Higher labor costs in certain regions can result in increased wharfage fees to cover operational expenses.

- Regulatory Changes: New government regulations or taxes can impact the cost structure of port operations, subsequently affecting wharfage rates.

- Vessel Size and Type: Larger vessels require more space and resources, leading to higher fees. Additionally, specialized vessels may incur additional charges for tailored services.

- Seasonality: During peak shipping seasons, such as the holiday period, ports may experience higher demand, resulting in elevated wharfage fees. Conversely, off-peak seasons might see reduced rates or promotional discounts.

Understanding these factors is essential for shipping companies to anticipate cost variations and strategize accordingly. The International Chamber of Shipping provides extensive resources on how these variables impact wharfage fees globally.

How to Negotiate Wharfage Fees with Your Service Provider

Negotiating wharfage fees is a strategic process that can lead to significant cost savings. Here are key considerations for effective negotiation:

- Volume of Cargo: Shipping larger volumes can provide leverage for negotiating lower fees. Service providers may offer discounts for bulk shipments, benefiting from economies of scale.

- Type of Cargo: Certain cargo types may warrant reduced fees, especially if they contribute to the diversification of the port’s operations or require minimal handling resources.

- Contract Length: Committing to a longer-term agreement can result in more favorable rates. Long-term contracts provide service providers with revenue stability, incentivizing them to offer discounts.

- Performance Metrics: Establishing clear performance metrics and service level agreements can ensure that both parties meet expectations, fostering a mutually beneficial relationship.

It's crucial to thoroughly understand the terms and conditions of any contract before finalizing agreements to avoid unforeseen expenses. Engaging with a maritime consultant or legal advisor can provide additional insights and support during the negotiation process.

The Maritime Executive offers valuable tips and strategies for negotiating favorable port fees.

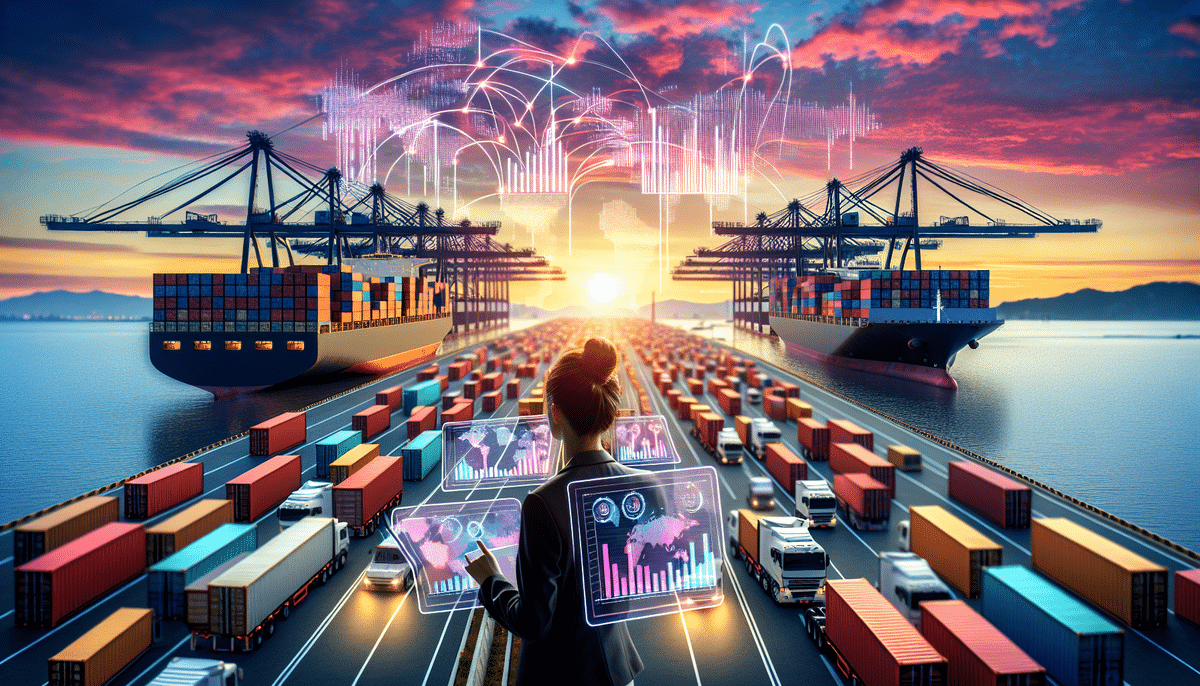

The Role of Technology in Modern Wharfage Management

Advanced technology has revolutionized wharfage management, enhancing efficiency and transparency in port operations. Key technological advancements include:

- Automation Systems: Automated cranes and handling equipment streamline cargo movement, reducing turnaround times and operational costs.

- Data Analytics: Sophisticated software systems analyze vast amounts of data to optimize port operations, predict congestion, and manage resources effectively.

- Real-Time Tracking: IoT devices and GPS tracking offer real-time monitoring of cargo and vessel movements, improving coordination and reducing delays.

- Blockchain Technology: Implementing blockchain enhances transparency and security in transactions, minimizing disputes related to wharfage fees and cargo handling.

These technologies not only improve operational efficiency but also contribute to safer and more secure port environments. However, challenges such as data privacy concerns and the need for continuous investment in technology infrastructure must be addressed to fully leverage these advancements.

The MIT Center for Maritime Transportation explores the impact of emerging technologies on port management and wharfage optimization.

Common Legal Issues Surrounding Wharfage and How to Address Them

Wharfage fees can sometimes lead to legal disputes and challenges within the shipping industry. Common legal issues include:

- Transparency and Fairness: Disputes may arise over the transparency of fee calculations and the fairness of charges imposed by port authorities.

- Antitrust and Competition Laws: Monopolistic practices or collusion among port authorities can lead to violations of competition laws, attracting legal scrutiny.

- Environmental Regulations: Non-compliance with environmental standards can result in additional fees, fines, or legal actions against shipping companies.

- Contractual Disputes: Misunderstandings or disagreements regarding contract terms related to wharfage fees can lead to legal conflicts.

To mitigate these legal risks, shipping companies should ensure clear and comprehensive contract terms, maintain transparency in fee negotiations, and stay informed about relevant regulations and industry standards. Consulting with legal experts specializing in maritime law can provide valuable guidance in navigating these challenges.

The International Chamber of Shipping provides resources and support for addressing legal issues related to wharfage and other maritime operations.

Wharfage vs. Demurrage: Understanding the Difference

While both wharfage and demurrage fees pertain to port operations, they address different aspects of maritime logistics:

- Wharfage: Fees charged for the use of port facilities such as docks, wharfs, and storage areas. These are typically based on factors like cargo type, vessel size, and duration of stay.

- Demurrage: Charges levied on vessels that occupy port facilities beyond the agreed-upon free time for loading and unloading cargo. Demurrage fees compensate for the extended use of port resources and aim to encourage efficient cargo handling.

Understanding the distinction between these fees is vital for shipping companies to manage costs effectively. Proper planning and efficient operations can help minimize both wharfage and demurrage expenses, enhancing overall profitability.

According to the American National Library, proactive strategies in scheduling and resource allocation can significantly reduce the incidence of demurrage charges.

The Future of Wharfage: Trends and Predictions for the Industry

The future of wharfage is poised to be influenced by several emerging trends and technological advancements:

- Automation and AI Integration: Continued adoption of automation and artificial intelligence will further streamline port operations, optimizing wharfage fee calculations and enhancing service delivery.

- Sustainability Initiatives: Increasing emphasis on environmental responsibility will drive ports to adopt greener practices, potentially introducing eco-friendly wharfage fee structures.

- Global Supply Chain Shifts: Changes in global trade patterns and supply chain dynamics will necessitate adaptable wharfage models to accommodate evolving shipping needs.

- Blockchain Technology: Enhanced transparency and security through blockchain will redefine transactional processes, reducing disputes related to wharfage fees.

- Smart Ports: The development of smart ports with integrated technologies will revolutionize wharfage management, offering real-time data and predictive analytics for better decision-making.

These trends indicate a move towards more efficient, transparent, and sustainable port operations. Shipping companies and port authorities must stay abreast of these developments to remain competitive and compliant with evolving industry standards.

Insights from the Maritime Executive forecast significant advancements in port technology and operational methodologies over the next decade.

Case Studies: Successful Implementation of Wharfage Strategies by Leading Companies

Examining real-world examples of effective wharfage strategies provides valuable lessons for shipping companies aiming to optimize their operations:

- Maersk Line: By leveraging advanced data analytics and automation technologies, Maersk has streamlined its port operations, reducing turnaround times and minimizing wharfage costs. Their investment in smart port initiatives has set a benchmark for efficiency in the shipping industry.

- DP World: DP World has implemented dynamic pricing models for wharfage fees, adjusting rates based on real-time demand and operational capacity. This flexible approach has enhanced their competitiveness and attracted a diverse range of shipping partners.

These case studies demonstrate the importance of adopting innovative technologies and flexible pricing strategies in managing wharfage effectively. By learning from industry leaders, other companies can implement similar strategies to achieve cost savings and operational excellence.

For more detailed insights, refer to the case studies available on the DP World website and the Maersk Line corporate reports.

Tips for Reducing Your Wharfage Costs Without Compromising on Quality

Reducing wharfage costs while maintaining high service quality is achievable through strategic planning and operational efficiency. Here are some effective strategies:

- Negotiate Favorable Terms: Engage in proactive negotiations with port authorities to secure better rates or seek discounts based on volume commitments or long-term contracts.

- Optimize Cargo Loads: Efficiently load and balance cargo to maximize vessel capacity and reduce the number of trips required, thereby lowering overall wharfage expenses.

- Adopt Advanced Scheduling: Utilize scheduling software to plan arrivals and departures during off-peak hours, avoiding premium rates associated with high-demand periods.

- Implement Efficient Operations: Streamline loading and unloading processes through automation and staff training to minimize vessel dwell time and associated fees.

- Explore Alternative Routes: Consider utilizing alternative ports or shipping routes that offer more competitive wharfage rates without sacrificing service quality.

By implementing these strategies, shipping companies can effectively manage and reduce wharfage costs, enhancing their overall competitiveness and profitability without compromising on the quality of service.

For additional strategies and best practices, refer to the resources provided by the International Chamber of Shipping.