What Are Green Returns? An Overview of Sustainable Investing

Sustainable investing, also known as socially responsible investing, takes into account an entity’s environmental, social, and governance (ESG) factors. Investors engaging in sustainable investing aim to generate financial returns while promoting positive social or environmental outcomes.

Why Sustainable Investing is Gaining Popularity

With increasing awareness of global issues such as climate change and social injustices, investors are aligning their investment portfolios with their ethical beliefs. According to the Global Sustainable Investment Alliance, sustainable investing assets reached $35.3 trillion in 2020, representing 36% of all professionally managed assets globally. This growth reflects a significant shift towards mindful investing, where contributing to a better future is as important as financial gain.

Another reason for the growing popularity of sustainable investing is the potential for long-term financial returns. Companies that prioritize sustainability are often better equipped to manage risks and adapt to changing market conditions, leading to more stable and consistent returns for investors. Studies, such as those from MSCI, have shown that companies with strong ESG performance tend to outperform their peers over the long term.

Furthermore, sustainable investing can positively impact society and the environment. By investing in companies that prioritize sustainability, investors support initiatives such as renewable energy, clean technology, and fair labor practices, fostering a more equitable and sustainable future for all.

The Concept of Green Returns in Sustainable Investing

Green returns, also known as impact returns, refer to the financial returns generated from investments that contribute to positive environmental or social outcomes. These returns can be measured quantitatively, such as the reduction in carbon emissions, or qualitatively, such as the improvement in working conditions for employees. Green returns benefit both the investor and society, promoting a more sustainable and equitable future.

One key benefit of investing in green returns is the potential for long-term financial stability. By investing in companies that prioritize sustainability and social responsibility, investors can help mitigate risks associated with environmental and social issues. For example, companies focused on reducing their carbon footprint may be better positioned to navigate future regulations and market shifts related to climate change.

Additionally, green returns offer the potential for positive impact beyond financial gains. By supporting companies that prioritize sustainability, investors can drive positive change in areas such as environmental protection, social justice, and human rights, contributing to a healthier planet and a more just society.

Understanding ESG Criteria for Investment Decisions

When making investment decisions, investors consider several ESG criteria:

- Environmental: Sustainability practices such as mitigating carbon emissions, reducing waste, and managing natural resources.

- Social: Factors like labor standards, human rights, community development, and customer relations.

- Governance: Management practices including executive compensation, board structure, and shareholder rights.

It's important to note that ESG criteria can vary depending on the industry and region. For instance, a company in the energy sector may have different environmental criteria compared to a technology company. Additionally, cultural norms and regional regulations can influence social criteria. Therefore, investors must carefully evaluate the ESG criteria relevant to each specific investment opportunity.

How to Identify Sustainable Investment Opportunities

Investors can identify sustainable investment opportunities by researching entities that align with their ethical beliefs and prioritize ESG factors. Strategies include:

- Investing in themed funds that focus on specific sustainability themes such as renewable energy or water conservation.

- Reviewing sustainability reports and corporate social responsibility (CSR) disclosures to assess a company's ESG performance.

- Engaging with companies to encourage the improvement of their sustainability practices and transparency.

Utilizing tools like the Morningstar Sustainability Rating can also help investors evaluate and compare the ESG performance of different companies.

An Insight into the Benefits of Investing in Sustainable Companies

Investing in sustainable companies offers several benefits beyond financial returns:

- Higher Profitability and Stability: Sustainable companies often exhibit better management practices, leading to higher profitability and long-term stability.

- Loyal Customer Base: Companies committed to sustainability tend to attract and retain loyal customers who support their values, enhancing revenue and brand reputation.

- Positive Environmental and Social Impact: Sustainable companies focus on reducing their carbon footprint, conserving natural resources, and promoting social responsibility, contributing to a better future for the planet and its inhabitants.

The Role of Technology in Advancing Sustainable Investing

Technology plays a significant role in advancing sustainable investing by:

- Enhancing data collection and analysis, making it easier for investors to evaluate ESG criteria.

- Facilitating the development of new investment products aligned with sustainability themes, such as green bonds and exchange-traded funds (ETFs).

- Improving transparency and accountability through technologies like blockchain, allowing investors to track the real-time impact of their investments.

These technological advancements ensure that investments are socially and environmentally responsible, increasing investor confidence and driving further adoption of sustainable investing practices.

The Challenges and Risks Involved in Sustainable Investing

Despite its benefits, sustainable investing presents several challenges and risks:

- Lack of Standardization: Inconsistent sustainability reporting standards can make it difficult to compare ESG factors across different entities.

- Greenwashing: Some companies may exaggerate their sustainability efforts to attract investors, making it challenging to accurately assess their true ESG performance.

- Market Volatility: Sustainable companies, especially those in emerging sectors, may experience higher volatility due to their relative novelty in the market.

- Long-Term Horizon: Sustainable investing often requires a longer investment horizon, which may not align with investors seeking short-term gains.

Addressing these challenges involves thorough research, utilizing reputable ESG rating agencies, and maintaining a diversified investment portfolio to mitigate potential risks.

Top Industries for Green Returns: Renewable Energy, Clean Water, and More

Several industries offer promising green returns for sustainable investors:

- Renewable Energy: The shift towards clean energy sources like solar, wind, and hydroelectric power continues to drive growth in this sector.

- Clean Water: Investments in technologies and infrastructure that ensure access to clean water are essential for sustainable development.

- Sustainable Agriculture: With increasing demand for organic and locally sourced food, sustainable agriculture practices are becoming more important for both financial returns and environmental health.

These industries not only provide financial opportunities but also address critical global challenges, making them attractive for impact-driven investors.

A Comparison of Traditional Investing vs. Sustainable Investing

Traditional investing primarily focuses on generating financial returns, while sustainable investing also considers the social and environmental impact of investments. Key differences include:

- Approach to Risk Management: Traditional investing emphasizes minimizing financial risk, whereas sustainable investing also accounts for non-financial risks like environmental and social factors.

- Investment Goals: Traditional investing targets short-term profitability, while sustainable investing aims for long-term growth and stability, alongside positive societal impact.

- Impact on Society and Environment: Sustainable investing actively seeks to contribute to social and environmental progress, whereas traditional investing may not prioritize these aspects.

By adopting a more holistic approach to risk and return, sustainable investing can help investors achieve not only financial success but also contribute to a more resilient and equitable world.

Tools and Resources for Evaluating the Impact of Sustainable Investments

Several tools and resources are available to help investors evaluate the impact of their sustainable investments:

- Global Reporting Initiative (GRI): Provides ESG reporting standards that help organizations disclose their sustainability performance.

- Sustainability Accounting Standards Board (SASB): Offers sector-specific sustainability accounting standards to guide transparent reporting.

- United Nations Sustainable Development Goals (SDGs): A framework for measuring the social, environmental, and economic impact of investments, allowing investors to align their portfolios with global sustainability targets.

- Sustainability-Themed Funds and ETFs: Offer investors exposure to various sustainable industries and themes, simplifying the process of building a sustainable portfolio.

Utilizing these resources can enhance an investor's ability to make informed decisions and accurately assess the impact of their investments.

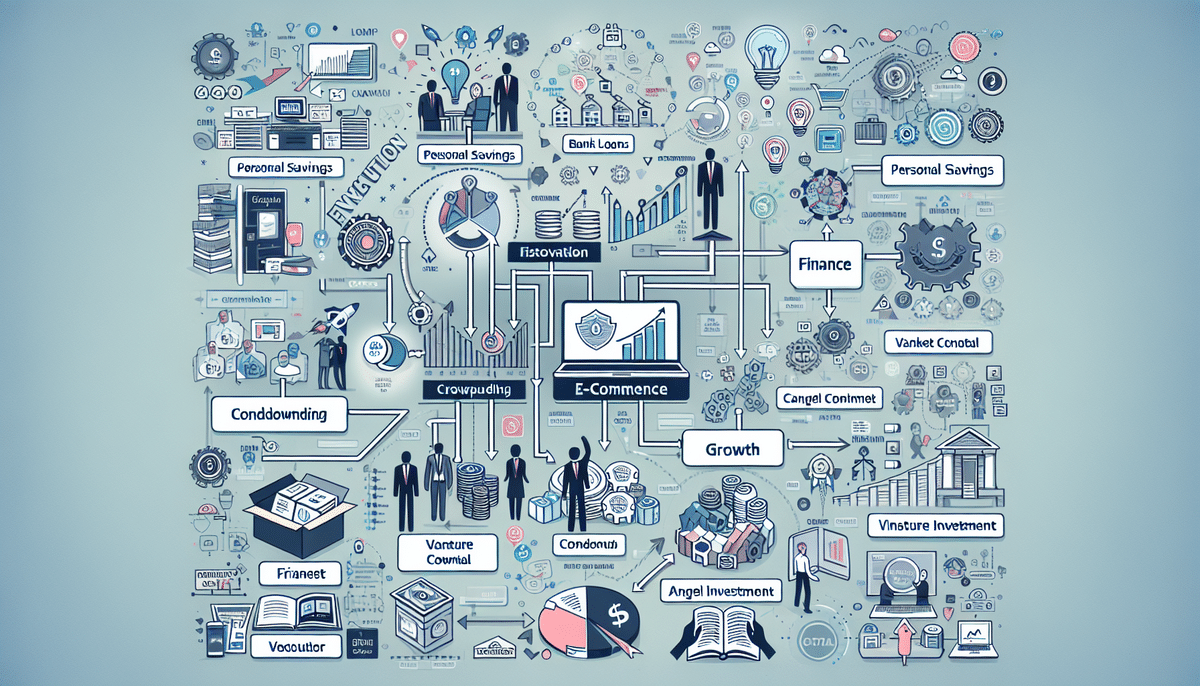

How to Incorporate Sustainable Investments into Your Portfolio

Investors can integrate sustainable investments into their portfolios through several strategies:

- Allocation to Sustainable Companies or Themes: Dedicate a portion of the portfolio to companies or sectors that demonstrate strong ESG performance.

- ESG-Themed Funds or ETFs: Invest in funds that focus on sustainable industries, providing diversified exposure to multiple ESG-compliant companies.

- Impact Investing: Focus on investments that aim to generate positive social or environmental impacts alongside financial returns, utilizing avenues like private equity, venture capital, or crowdfunding platforms.

Researching companies’ sustainability practices, reviewing their ESG reports, and staying informed about their ongoing sustainability efforts are crucial steps in making informed sustainable investment decisions.

Key Players in the Sustainable Investment Industry

The sustainable investment industry includes several key players, such as:

- Investment Management Firms: Firms like BlackRock, State Street Global Advisors, and Pax World Funds offer a range of sustainable investment products and services.

- Thematic Funds: Focus on specific sustainability themes, providing investors with targeted exposure to areas like renewable energy or water conservation.

- Advisory Services: Provide guidance on integrating ESG factors into investment strategies and portfolios.

- Impact Investing Firms: Companies like Acumen, Bridges Fund Management, and Triodos Investment Management focus on investments that generate measurable social and environmental impacts alongside financial returns.

Best Practices for Making Ethical and Responsible Investment Decisions

To make ethical and responsible investment decisions, investors should follow these best practices:

- Evaluate ESG Criteria: Assess the environmental, social, and governance factors of potential investments to ensure they align with your ethical standards.

- Diversify Your Portfolio: Spread investments across different sectors and asset classes to mitigate risks and enhance sustainability impact.

- Conduct Thorough Research: Utilize sustainability reports, ESG ratings, and third-party analyses to inform your investment choices.

- Stay Informed: Regularly review companies’ sustainability practices and stay updated on industry trends and regulatory changes.

- Engage with Companies: Participate in shareholder meetings and dialogues to encourage companies to improve their ESG performance.

By adhering to these practices, investors can ensure their portfolios reflect their ethical beliefs and contribute to responsible and sustainable growth.

The Future of Sustainable Investing: Trends and Predictions

The future of sustainable investing is poised for continued growth, driven by several key trends:

- Increased Focus on Climate Change and Social Justice: Investors are prioritizing issues related to climate action, social equity, and responsible governance.

- Standardization in Sustainability Reporting: Efforts are underway to create more uniform ESG reporting standards, enhancing comparability and transparency.

- Technological Advancements: Innovations in data analytics and blockchain technology are improving ESG data accuracy and investment transparency.

- Greater Collaboration Among Investors: Increased cooperation among institutional investors aims to achieve common sustainability goals and drive systemic change.

- Integration of ESG Factors Across All Asset Classes: ESG considerations are becoming integral to investment decisions across equities, fixed income, real estate, and alternative investments.

In conclusion, sustainable investing is a dynamic and expanding sector that not only seeks financial returns but also strives to generate meaningful social and environmental impacts. As awareness and demand for responsible investing grow, investors have the opportunity to align their portfolios with their values, contributing to a more sustainable and equitable future.