Understanding FIFO Inventory Management and Valuation in Ecommerce

As an ecommerce business owner, you’re always on the lookout for ways to improve your operations. One area that often requires careful consideration is inventory management. Accurate inventory management is essential for ensuring that you always have enough stock to meet customer demand while minimizing the risk of overstocking. Additionally, accurate inventory valuation is crucial for keeping your financial records accurate and up to date.

What is FIFO Inventory Management and How Does it Work in Ecommerce?

FIFO inventory management stands for First-In, First-Out. This method assumes that the first items added to your inventory are the first ones sold. By selling older inventory first, you turn over your stock more quickly and reduce the risk of holding outdated or obsolete products. This approach is favored by many ecommerce businesses because it helps maintain product freshness and optimize inventory turnover rates.

For instance, if you sell t-shirts and receive new shipments regularly, FIFO ensures that older t-shirts are sold before newer arrivals. This practice not only promotes faster inventory turnover but also enhances profitability by reducing the need for discounting older stock.

However, FIFO may not be suitable for all products. For perishable goods like food or medicine, methods like FEFO (First-Expiry, First-Out) are more appropriate to ensure products are sold before expiration. Similarly, for products with rapidly changing trends or short shelf lives, alternative inventory methods might be more effective to prevent excess inventory.

The Importance of Accurate Inventory Valuation

Accurate inventory valuation is essential for maintaining precise financial records and making informed business decisions. Incorrect valuations can lead to financial discrepancies, impacting tax obligations and perceived profitability. For example, overstating inventory may result in overpaid taxes, while understating it can lead to tax underpayment and inflated profits.

The FIFO method is widely regarded as an accurate inventory valuation method because it reflects the actual flow of goods. This is particularly beneficial for products with high turnover rates, such as seasonal items or perishable products.

Additionally, accurate inventory valuation ensures you have sufficient stock to meet customer demand, avoiding stockouts that can lead to lost sales and dissatisfied customers. It also helps in identifying which products are performing well, facilitating better inventory planning and management.

Benefits and Challenges of FIFO Inventory Management

Benefits of FIFO

- Faster inventory turnover

- Higher profits due to quicker stock movement

- Accurate inventory valuation

- Avoidance of overstocking or understocking

- Reduced storage costs

- Enhanced financial record accuracy

Challenges of FIFO

Despite its benefits, FIFO inventory management presents several challenges:

- Risk of stock obsolescence for non-perishable items

- Requires meticulous inventory tracking and organization

- May not be suitable for all product types

- Potential higher administrative costs if not automated

To overcome these challenges, ecommerce businesses can invest in robust inventory management software, regularly review inventory levels, and implement best practices to streamline their FIFO processes.

Choosing Between FIFO and LIFO Inventory Valuation Methods

Another common inventory valuation method is LIFO (Last-In, First-Out). LIFO assumes that the most recently acquired items are sold first. This method can lead to a higher cost of goods sold during periods of inflation, potentially reducing taxable income. However, it may not accurately reflect the actual flow of goods for businesses with perishable or fast-moving inventory.

Choosing the right method depends on various factors, including the nature of your products, turnover rates, and financial considerations. FIFO is generally preferred for its alignment with actual inventory flow and its benefits for financial accuracy, especially in scenarios involving rising costs.

Implementing FIFO Inventory Management: Best Practices and Tips

Best Practices

- Invest in inventory management software to automate tracking

- Train your team on FIFO principles and procedures

- Conduct regular inventory audits to ensure accuracy

- Properly label and organize inventory to facilitate FIFO

- Establish clear procedures for receiving and storing inventory

Tips for Efficient Management

- Regularly review and adjust inventory levels based on sales data

- Implement barcode or RFID systems for better tracking

- Monitor inventory turnover rates and identify improvement areas

- Use forecasting tools to anticipate demand and manage stock accordingly

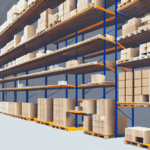

The Role of Technology in FIFO Inventory Management

Technology plays a critical role in streamlining FIFO inventory management. Advanced inventory management software automates tracking, reduces errors, and provides real-time insights into inventory levels and turnover rates.

Technologies such as barcoding and RFID enable precise tracking of inventory as it moves through the supply chain, ensuring that FIFO principles are adhered to consistently. Integrating these technologies can enhance efficiency, accuracy, and overall inventory management performance.

Assessing and Improving FIFO Inventory Performance

Regularly evaluating the performance of your FIFO inventory system is essential for continuous improvement. FIFO analysis helps identify how long items remain in inventory, the rate at which they are sold, and overall inventory efficiency.

By analyzing sales data and inventory turnover rates, ecommerce businesses can identify trends, adjust inventory levels, and make informed decisions about product stocking and discontinuation. This process ensures that inventory management practices remain effective and aligned with business goals.

Ensuring Compliance and Accurate Financial Reporting

Compliance with FIFO inventory accounting standards is crucial for accurate financial reporting and tax obligations. Adhering to guidelines set by accounting standards boards ensures that your inventory valuation is consistent and transparent.

Using inventory management software can help maintain accurate records, facilitate compliance, and provide detailed reports needed for audits and financial assessments. Ensuring compliance not only supports financial accuracy but also builds trust with stakeholders and regulatory bodies.

The Future of FIFO Inventory Management in Ecommerce

As ecommerce continues to evolve, FIFO inventory management is likely to remain a fundamental practice for effective inventory control and financial accuracy. Advancements in technology will further enhance the efficiency and precision of FIFO systems, making it easier for businesses to manage their inventory and adapt to changing market demands.

Staying updated with the latest inventory management trends and technologies will enable ecommerce businesses to maintain a competitive edge, optimize their operations, and sustain growth in a dynamic digital marketplace.