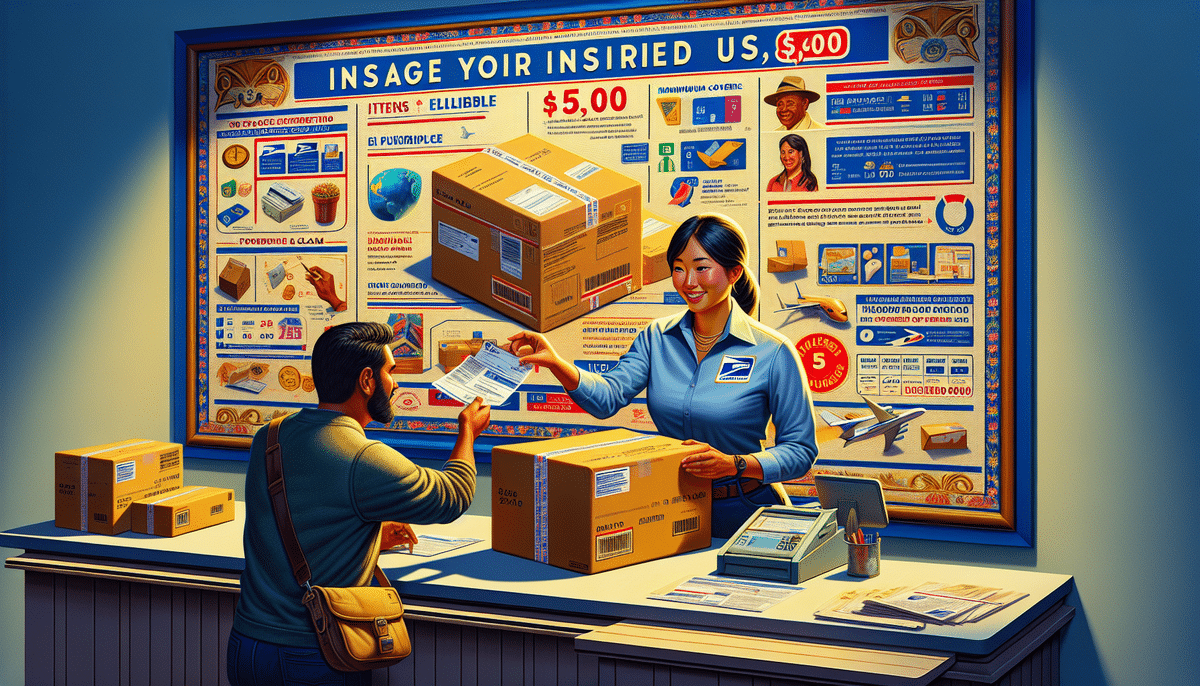

Understanding USPS Insurance Limits in 2024

Sending valuable items through the mail requires careful consideration, especially when it comes to protecting your shipments. USPS insurance provides a safeguard against loss or damage, ensuring peace of mind and financial protection. This comprehensive guide delves into USPS insurance, covering its costs, eligible items, claim filing processes, common denial reasons, and tips to maximize your coverage.

What is USPS Insurance?

USPS insurance is a service offered by the United States Postal Service that allows you to insure your mail against loss or damage during transit. By declaring the value of your item, USPS ensures reimbursement up to the amount you choose. This service is essential for sending high-value items such as electronics, jewelry, and collectibles.

Importance of USPS Insurance

Accidents can occur during shipping, from mishandling to unforeseen delays. USPS insurance provides financial protection, covering the declared value of your item if it’s lost or damaged. This protection is crucial for both personal and business shipments, ensuring that valuable goods reach their destination intact.

Eligible Items for USPS Insurance

USPS insurance covers a wide range of mailable items, but there are restrictions. Understanding what can and cannot be insured helps in selecting the right shipping method and ensuring coverage.

Items That Can Be Insured

- Packages and envelopes

- Priority Mail and Priority Mail Express shipments

- Valuable items like electronics, jewelry, and collectibles

Items That Cannot Be Insured

- Perishable goods

- Live animals

- Hazardous materials

- Cash and precious metals

For a comprehensive list of eligible and ineligible items, refer to the USPS Mail Services page.

How USPS Insurance Works

Understanding the mechanics of USPS insurance helps you make informed decisions when shipping valuable items.

Declaring the Value

When you purchase USPS insurance, you declare the item's value, which determines the coverage amount. The cost of insurance varies based on this declared value.

Filing a Claim

If your insured item is lost or damaged, you can file a claim with USPS. The process involves providing proof of value, such as receipts or appraisals, and completing a claim form.

Claim Investigation and Reimbursement

USPS investigates the claim and, if approved, reimburses the declared value. Reimbursements do not cover shipping fees or taxes, only the item's value.

Cost of USPS Insurance

The cost of USPS insurance depends on the declared value and the level of coverage selected.

Coverage Tiers

- Priority Mail Express: Includes up to $100 of insurance

- Priority Mail: Includes up to $50 of insurance

- Additional Coverage: Purchase up to $5,000 for high-value items

Pricing Structure

The insurance cost starts at $1.25 for $100 coverage and scales up to $83.50 for $5,000 coverage. Detailed pricing can be found on the USPS Insurance Coverage page.

Filing a USPS Insurance Claim

In the unfortunate event that your insured item is lost or damaged, filing a claim promptly is essential.

Steps to File a Claim

- Gather necessary documentation: receipts, photos, and proof of value.

- Complete the USPS claim form.

- Submit the claim online or at a local post office.

- Pay any applicable processing fees.

Tracking Your Claim

After submission, you can track the status of your claim through the USPS website or by contacting USPS customer service.

Common Reasons for Claim Denials

Understanding why claims are denied can help you avoid common pitfalls and ensure successful reimbursement.

Improper Packaging

Items must be adequately packaged to prevent damage. Improper packaging can lead to claim denial.

Ineligible Items

Shipping items that are not covered, such as perishables or live animals, will result in claim denial.

Insufficient Proof of Value

Failing to provide adequate documentation of the item’s value can lead to claim rejection.

Maximizing Your USPS Insurance Coverage

To ensure comprehensive protection, follow these best practices when using USPS insurance.

Proper Packaging and Labeling

Use sturdy packaging materials and clearly label your shipments to reduce the risk of damage and ensure eligibility for insurance.

Accurate Value Declaration

Declare the correct value of your items to ensure adequate coverage. Over- or under-declaring can cause issues during claims.

Maintain Documentation

Keep all receipts, photos, and other relevant documents to support any future claims.

Consider Additional Insurance

For extremely high-value items, consider purchasing additional insurance from a third-party provider to exceed USPS’s maximum coverage.

Alternatives to USPS Insurance

While USPS insurance is a reliable option, exploring alternatives can provide additional benefits based on your specific needs.

Private Shipping Insurance

Private carriers like FedEx and UPS offer their own insurance policies, which may offer higher coverage limits and different terms.

Credit Card Purchase Protection

Some credit cards offer purchase protection that covers lost or damaged items. Check with your card issuer for details and eligibility.

Self-Insurance

Setting aside funds to cover potential losses is another strategy, though it lacks the formal protection mechanisms of insurance policies.

Best Practices for Shipping High-Value Items

When shipping high-value items, taking extra precautions ensures their safe and secure delivery.

Use High-Quality Packaging

Sturdy boxes, bubble wrap, and padding materials help protect items from damage during transit.

Securely Seal Packages

Proper sealing prevents tampering and further protects the contents from environmental factors.

Choose Reliable Shipping Options

Selecting services like Priority Mail Express can offer expedited shipping and included insurance benefits.

Insure Appropriately

Ensure the declared value matches the item's worth and consider additional insurance for exceptionally valuable items.

Conclusion

USPS insurance is a vital tool for safeguarding your valuable shipments against loss and damage. By understanding its benefits, limitations, and the proper steps to take, you can ensure your items reach their destination securely. Whether you opt for USPS insurance or explore alternative options, protecting your valuable items during shipping is essential for both peace of mind and financial security.

For more information on USPS insurance and to access resources for shipping valuable items, visit the official USPS website.