Addressing E-Commerce Challenges: Managing Risk and Ensuring Financial Stability

In today’s digital age, e-commerce has revolutionized the way businesses operate. With the rise of online transactions, it has become increasingly important for businesses to manage risk and ensure financial stability. This article explores the importance of risk management in e-commerce, the common risks faced by businesses, and effective strategies to mitigate these risks. We will also delve into the role of insurance, best practices for secure online transactions, and the significance of cash flow management and inventory control to maintain a strong financial foundation. Let’s dive in!

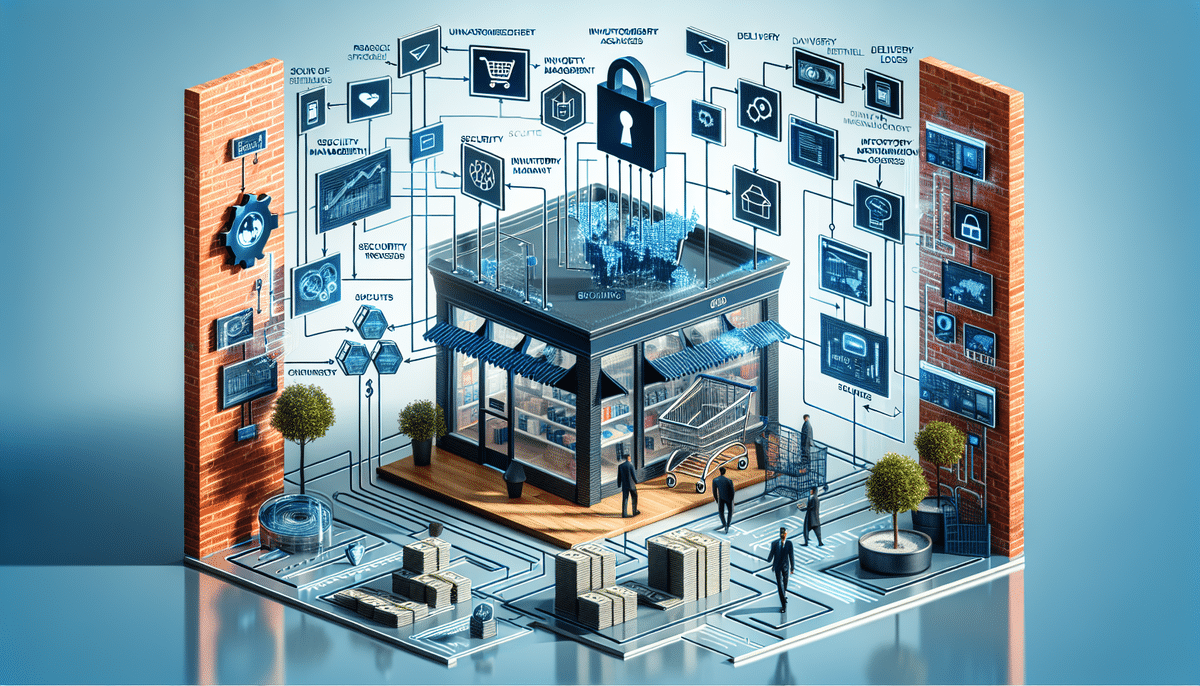

The Importance of Risk Management in E-Commerce

Risk management is a cornerstone of successful e-commerce operations. As online businesses navigate the digital marketplace, they encounter a variety of risks that can impede their growth and sustainability. Effective risk management strategies help businesses anticipate potential threats, minimize their impact, and ensure long-term financial stability.

According to the Cisco 2023 Cybersecurity Report, cyber threats to e-commerce have increased by 40% over the past year, underscoring the critical need for robust risk management protocols.

Common Risks Faced by E-Commerce Businesses

Cyber Attacks

E-commerce platforms are prime targets for cybercriminals aiming to steal sensitive customer data, including credit card information and personal details. A 2023 report by the FBI’s Internet Crime Complaint Center noted a 25% increase in cyber attacks targeting online retailers.

Fraud

Fraudulent activities, such as chargebacks, fake orders, and identity theft, pose significant financial risks. According to the Federal Trade Commission, e-commerce fraud cases rose by 18% in 2023.

Data Breaches

Data breaches can result from inadequate security measures, leading to compromised customer information and loss of trust. The Verizon 2023 Data Breach Investigations Report indicates that 60% of data breaches involve web applications.

Delivery Issues

Issues such as lost shipments, delayed deliveries, or incorrect orders can lead to customer dissatisfaction and revenue loss. The GlobalTranz eCommerce Report highlights that 30% of e-commerce businesses face significant delivery challenges annually.

Compliance Issues

E-commerce businesses must comply with various legal and regulatory standards. Non-compliance can result in legal penalties and damage to the business’s reputation. The U.S. Department of Commerce provides guidelines on compliance requirements for online businesses.

Identifying and Evaluating E-Commerce Risks

Assessing the Likelihood of Risks

Understanding the probability of potential risks allows businesses to prepare and mitigate their impact effectively.

Evaluating the Potential Impact

Assessing the potential consequences of each risk helps prioritize risk management efforts and allocate resources appropriately.

Investigating Past Incidents

Learning from past incidents provides valuable insights into potential risks and effective mitigation strategies.

Conducting Security Assessments

Regular security assessments help identify vulnerabilities in the business's systems and processes, enabling proactive risk management.

Creating a Risk Management Plan for Your E-Commerce Business

Risk Avoidance

Avoiding activities that could lead to risks altogether, thereby eliminating potential threats before they materialize.

Risk Reduction

Implementing security measures and best practices to reduce the likelihood and impact of identified risks.

Risk Transfer

Transferring risk to third parties, such as insurance companies or outsourcing services, to mitigate financial exposure.

Risk Acceptance

Accepting certain risks and preparing contingency plans to address them if they occur.

Strategies for Mitigating Financial Risks in E-Commerce

Monitoring Cash Flow

Regular monitoring of cash flow helps businesses identify potential financial issues early, allowing for proactive measures to maintain stability.

Inventory Management

Effective inventory management ensures that businesses maintain optimal stock levels, preventing overstocking or stockouts that can affect cash flow.

Budget and Finance Management

Developing a solid budgeting strategy allows businesses to plan for expenses, allocate resources efficiently, and manage cash flow effectively.

Diversifying Revenue Streams

Establishing multiple revenue streams reduces dependence on a single source, mitigating financial risks during market fluctuations.

The Role of Insurance in E-Commerce Risk Management

Cyber Insurance

Cyber insurance provides financial protection against losses related to cyber attacks and data breaches.

General Liability Insurance

General liability insurance covers third-party claims of bodily injury, property damage, and personal injury.

Product Liability Insurance

Product liability insurance offers coverage against third-party claims of injury or damages caused by a product.

Professional Liability Insurance

Professional liability insurance protects against claims of negligence or errors in professional services.

Secure Online Transactions and Fraud Prevention

Secure Payment Processing

Utilize reputable payment processors like PayPal and Stripe to ensure secure payment processing and protect customer data.

Adding Security Layers

Implementing additional security measures, such as two-factor authentication and advanced fraud detection systems, can significantly reduce the risk of fraudulent transactions.

Verifying Customer Information

Validating customer information, including shipping and billing addresses, helps prevent fraudulent orders and chargebacks.

Educating Customers on Phishing Scams

Providing customers with information on how to recognize and avoid phishing scams can enhance overall security and customer trust.

Best Practices for Secure Online Transactions in E-Commerce

Using SSL Certificates

SSL certificates encrypt sensitive data, such as credit card information, ensuring secure transactions. Implementing SSL certificates is essential for protecting customer information.

Keeping Software Up to Date

Regularly updating software prevents vulnerabilities that hackers can exploit, maintaining the security integrity of e-commerce platforms.

Limiting Access to Sensitive Data

Restricting access to sensitive data to authorized personnel minimizes the risk of data breaches and unauthorized access.

Using Strong Passwords

Implementing strong passwords and two-factor authentication helps prevent unauthorized access to sensitive data and accounts.

Ensuring Financial Stability for Your E-Commerce Business

Monitoring Cash Flow

Consistently tracking cash flow is crucial for identifying potential financial challenges and maintaining operational stability. Tools like QuickBooks or FreshBooks can aid in effective cash flow management.

Building a Strong Financial Foundation

A robust financial foundation is built on sound budgeting, effective financial management strategies, and diversified revenue streams, ensuring resilience against market volatility.

Managing Inventory and Cash Flow

Balancing inventory levels with cash flow demands prevents financial strain and ensures that the business can meet customer demands without excessive overhead costs.

Building a Strong Financial Foundation for Your E-Commerce Business

Creating a Budget

Developing a comprehensive budget helps businesses plan for future expenses, allocate resources appropriately, and set financial goals.

Investing in Financial Management Tools

Utilizing financial management software streamlines the tracking of income, expenses, and other financial metrics, facilitating informed decision-making.

Diversifying Revenue Streams

Establishing multiple revenue streams reduces reliance on a single income source, enhancing financial stability and growth potential.

Seeking Professional Advice

Consulting with financial advisors, accountants, and legal professionals ensures that the business’s financial practices are sound and compliant with regulations.

Managing Inventory and Cash Flow to Ensure Financial Stability

Regular Inventory Audits

Conducting regular inventory audits helps businesses identify excess or obsolete stock, preventing cash flow issues and reducing storage costs.

Establishing Reorder Points

Setting reorder points based on inventory levels and sales forecasts ensures that businesses maintain sufficient stock to meet customer demand while minimizing inventory costs.

Effective Cash Flow Management

Tracking cash inflows and outflows, forecasting future cash needs, and having contingency plans in place are essential for maintaining financial stability.

Optimizing Order Fulfillment

Implementing automated order fulfillment processes can reduce processing times, minimize errors, and free up staff time for other important tasks.

Strategies for Profitability and Sustainability in E-Commerce

Focus on Customer Satisfaction

Prioritizing customer satisfaction leads to repeat business and positive reviews, which can drive long-term profitability.

Invest in Marketing and Advertising

Effective marketing and advertising campaigns attract new customers and increase sales revenue. Utilizing platforms like Google Ads and Facebook Ads can enhance visibility and reach.

Explore New Markets

Entering new markets diversifies revenue streams and reduces reliance on a single market, enhancing financial sustainability.

Stay Up-to-Date with Technology

Adopting the latest technologies improves operational efficiency, reduces costs, and keeps the business competitive in the evolving e-commerce landscape.

The Future of E-Commerce: Trends and Predictions for Financial Stability

Increased Adoption of Mobile Commerce

With more consumers using smartphones and tablets for online shopping, businesses that adopt mobile-friendly technologies can gain a competitive edge. According to Statista, mobile commerce accounts for over 50% of total e-commerce sales globally.

The Rise of AI and Machine Learning

AI and machine learning technologies enable personalized customer experiences, optimize pricing strategies, and enhance customer service, driving efficiency and profitability.

Integration with Social Media Platforms

Integrating e-commerce with social media channels allows businesses to reach a broader audience, leverage social advertising, and facilitate seamless shopping experiences directly within social platforms.

The Shift Towards Sustainable E-Commerce

Consumers are increasingly prioritizing sustainability. E-commerce businesses that adopt environmentally friendly practices can enhance their brand reputation and attract eco-conscious customers, leading to increased loyalty and sales.

Conclusion

E-commerce businesses face a myriad of challenges in managing risks and ensuring financial stability. However, by implementing effective risk management strategies, securing online transactions, and maintaining robust financial practices, businesses can navigate these challenges successfully. Additionally, staying abreast of emerging trends ensures that e-commerce operations remain competitive and resilient in an ever-evolving digital landscape. Emphasizing customer satisfaction, leveraging technology, and building a strong financial foundation are key to achieving long-term profitability and sustainability.