Comparing International Paper and DS Smith in the Global Packaging Industry

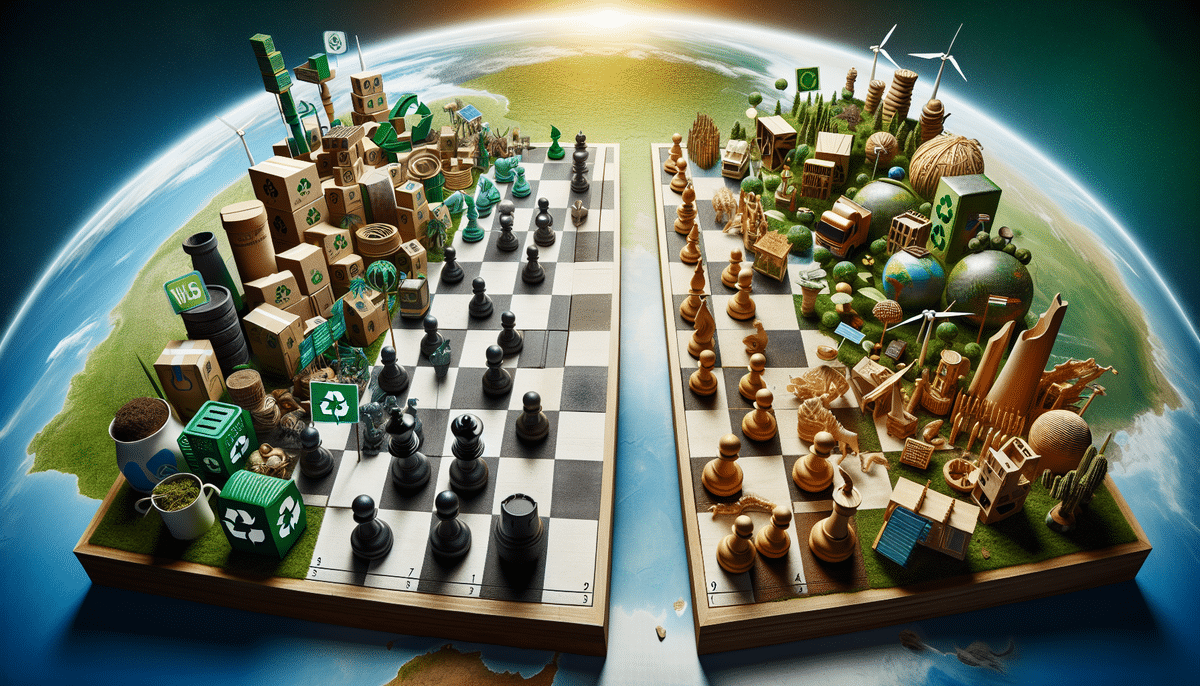

The global packaging industry is dominated by leading companies such as International Paper and DS Smith. Despite their shared focus on packaging solutions, these giants differ significantly in strategy, market presence, product offerings, and sustainability initiatives. This comprehensive analysis explores their market presence, sustainability goals, financial performance, innovation strategies, management teams, global trade policies, SWOT analyses, CSR initiatives, recent mergers and acquisitions, and future growth prospects.

Company Overviews

International Paper

International Paper (IP) is one of the world's largest paper and packaging companies, serving customers in over 150 countries. With a century-old legacy, IP's product portfolio includes corrugated packaging, pulp, and paper products. The company places a strong emphasis on sustainability, aiming to reduce its greenhouse gas emissions by 20% by 2030.

DS Smith

DS Smith is a UK-based diversified packaging company operating in 37 countries and employing over 30,000 people. The company specializes in sustainable corrugated packaging, plastics, and recycling solutions, with a commitment to manufacturing 100% reusable or recyclable packaging by 2025. DS Smith has been recognized for its innovative approaches in the circular economy.

Market Presence and Global Reach

International Paper's Global Footprint

International Paper maintains a robust global presence, particularly in North America, Europe, and Asia. The company's expansive operations cater to a diverse range of industries, including e-commerce, retail, and consumer goods. Recent expansions into international markets have bolstered IP's revenue growth and market share.

DS Smith's Regional Strengths

While DS Smith has a stronghold in Europe, especially in the UK where it is headquartered, it has been strategically expanding into North America and the Asia-Pacific regions. This diversification helps mitigate regional risks and opens up new revenue streams.

Product Lines and Innovation

International Paper's Product Diversity

IP offers a wide array of products, including corrugated boxes, paper bags, and pulp. The company invests heavily in research and development, leading to eco-friendly innovations like the Greencoat line of recyclable and compostable barrier coatings for paperboard packaging.

DS Smith's Sustainable Solutions

DS Smith focuses on sustainable packaging solutions and recycling services. Products like the AkyPak line of lightweight, reusable plastic containers exemplify their commitment to reducing waste and promoting a circular economy.

Sustainability Goals and Achievements

International Paper

IP has committed to reducing its greenhouse gas emissions by 20% by 2030 and has achieved recognition by ranking in the top 5% of companies in the Dow Jones Sustainability Index.

DS Smith

DS Smith aims to become a net-zero company by 2050 and to manufacture 100% reusable or recyclable packaging by 2025. The company holds an A- rating from the CDP for its sustainability efforts.

Financial Performance

Revenue and Profitability

In 2023, International Paper reported a revenue of approximately $22 billion, while DS Smith reported revenue of around GBP 6.5 billion. Both companies have shown resilience despite economic challenges, with IP's net income reaching $1.5 billion and DS Smith's net income increasing to GBP 210 million.

Impact of COVID-19

The COVID-19 pandemic posed challenges such as disrupted supply chains and fluctuating demand. However, both companies adapted by optimizing production processes and shifting focus to high-demand sectors like e-commerce packaging.

Innovation and Research & Development

International Paper's Innovation Centers

International Paper operates dedicated innovation centers focused on developing sustainable packaging solutions. These centers have been instrumental in launching products like Greencoat, which align with global sustainability trends.

DS Smith's 'Now and Next' Program

DS Smith's 'Now and Next' program aims to deliver next-generation sustainable packaging. This initiative has led to several award-winning products that enhance the company's market position and sustainability credentials.

Management and Leadership

International Paper's Leadership

IP's board of directors includes seasoned industry leaders with extensive experience across various sectors. This diverse leadership fosters strategic decision-making and drives the company's growth initiatives.

DS Smith's Executive Team

DS Smith's management team comprises industry veterans who have previously led major corporations like Reckitt Benckiser and Diageo. Their expertise contributes to DS Smith's strategic expansions and operational efficiencies.

Corporate Social Responsibility (CSR)

International Paper's CSR Initiatives

IP engages in numerous CSR activities, including investments in education, training, waste reduction, and promoting diversity and inclusion. The company has been recognized as one of the world's most ethical companies by Ethisphere for the 14th consecutive year.

DS Smith's CSR Efforts

DS Smith focuses on CSR by investing in community education, reducing emissions, and fostering workplace diversity. The company was honored as a responsible business champion by the UK’s Prince of Wales.

Mergers and Acquisitions

Recent Strategic Acquisitions by International Paper

In 2020, IP acquired Enviva’s wood pellet facilities, enhancing its renewable energy portfolio. Earlier, in 2016, IP acquired Weyerhaeuser’s pulp and paper operations, expanding its market reach.

DS Smith's Expansion through Acquisitions

DS Smith acquired Interstate Resources’ corrugated packaging business in 2017, Romanian packaging company Ecopack, and Spanish packaging firm Gopaca in 2020. These acquisitions have strengthened DS Smith's presence in key European markets.

Future Growth Prospects

Opportunities for International Paper

IP's expansion into international markets and continued investment in sustainable technologies position it well for future growth. The increasing demand for eco-friendly packaging solutions globally offers significant revenue potential.

DS Smith's Growth Strategy

DS Smith's diversification into plastics and recycling, along with its growing footprint in North America and Asia-Pacific, opens up new avenues for expansion. The rise of e-commerce and the shift towards sustainable packaging are key growth drivers.

Conclusion

International Paper and DS Smith are pivotal players in the global packaging industry, each with unique strengths and strategic focuses. While IP boasts a broader global presence and diverse product lines, DS Smith excels in sustainability and innovation within the circular economy. Both companies demonstrate strong financial performance and a commitment to sustainability, positioning them well to navigate future industry challenges and capitalize on emerging opportunities.