Comparing Critical E-Commerce Operations Metrics: Customer Acquisition Cost vs. Customer Lifetime Value

The world of e-commerce is constantly evolving, with businesses facing increasing competition and shifting consumer behaviors. To stay competitive and ensure long-term success, e-commerce businesses must continuously review and measure key metrics to optimize their operations. Two of the most critical metrics used to evaluate e-commerce performance are Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV).

Understanding Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) measures the total cost incurred to acquire a single customer. This metric is calculated by dividing the total costs associated with marketing, advertising, and sales efforts by the number of new customers acquired during a specific period.

Importance of CAC

Understanding CAC is vital as it helps businesses gauge the effectiveness of their marketing and sales strategies. A high CAC may indicate inefficiencies in these strategies, prompting a need for adjustment. Conversely, a lower CAC allows businesses to allocate more resources towards growth and expansion.

Calculating CAC

To calculate CAC, use the following formula:

- CAC = Total Marketing and Sales Expenses / Number of New Customers Acquired

For example, if a company spends $10,000 on marketing and sales in a month and acquires 100 new customers, the CAC would be $100.

Industry Benchmark

According to a Shopify report, the average CAC in the e-commerce industry varies but typically ranges between $10 to $150, depending on the niche and marketing strategies employed.

Understanding Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) estimates the total revenue a business can expect from a single customer account throughout the business relationship.

Importance of CLV

CLV provides insights into the long-term profitability of customers, guiding businesses in making informed decisions about marketing investments, customer retention strategies, and overall business growth.

Calculating CLV

CLV can be calculated using the following formula:

- CLV = (Average Purchase Value) × (Average Purchase Frequency) × (Customer Lifespan)

For instance, if the average purchase value is $50, the average purchase frequency is 5 times a year, and the customer lifespan is 3 years, the CLV would be $750.

Industry Insight

A study by Harvard Business Review highlights that increasing CLV by just 5% can boost profits by 25% to 95%.

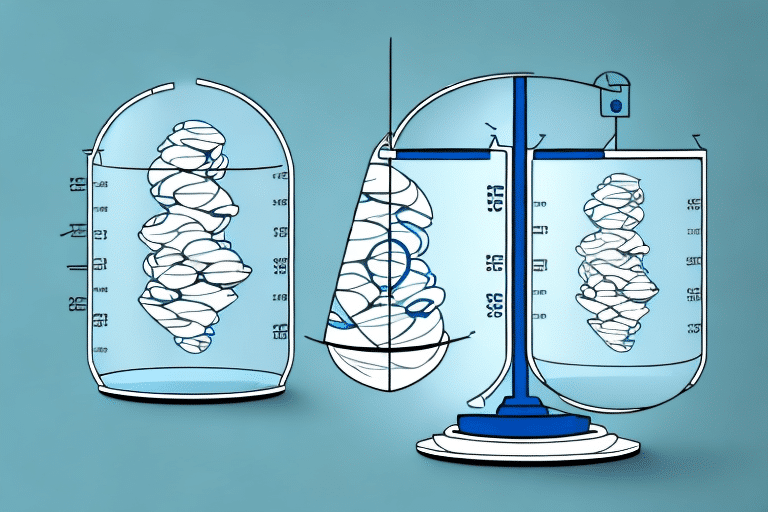

The Interplay Between CAC and CLV

While CAC and CLV are distinct metrics, they are inherently interconnected. The relationship between CAC and CLV determines the profitability of customer acquisition strategies.

Balancing CAC and CLV

For a sustainable business model, the CLV should significantly exceed the CAC. A common benchmark is a CLV to CAC ratio of 3:1, meaning the lifetime value of a customer is three times the cost of acquiring them.

Strategies to Optimize Both Metrics

- Enhance Customer Retention: Implement loyalty programs and personalized marketing to increase CLV.

- Improve Marketing Efficiency: Utilize targeted advertising and data-driven strategies to reduce CAC.

- Upsell and Cross-sell: Encourage existing customers to purchase additional products or higher-value items.

Strategies to Optimize CAC and CLV

Optimizing both CAC and CLV is essential for maximizing profitability and ensuring long-term business success.

Reducing Customer Acquisition Cost

- Targeted Marketing: Focus marketing efforts on specific demographics to improve conversion rates.

- Content Marketing: Invest in high-quality content to attract organic traffic and reduce reliance on paid advertising.

- Referral Programs: Encourage existing customers to refer new customers, often at a lower acquisition cost.

Increasing Customer Lifetime Value

- Personalization: Tailor recommendations and communications to individual customer preferences.

- Exceptional Customer Service: Provide timely and effective support to enhance customer satisfaction and loyalty.

- Subscription Models: Implement subscription services to ensure recurring revenue streams.

Case Studies: E-Commerce Success Stories

Amazon

Amazon excels in both low CAC and high CLV by offering a vast range of products, exceptional customer service, and a Prime membership program that encourages repeat purchases and loyalty.

Warby Parker

Warby Parker utilizes a robust referral program and personalized customer experiences to maintain a low CAC while significantly increasing CLV through repeat business and brand loyalty.

Dollar Shave Club

Dollar Shave Club leverages subscription-based models and targeted marketing campaigns to keep CAC low and CLV high, ensuring consistent revenue and customer retention.

Best Practices for Measuring and Managing CAC and CLV

Implementing best practices in measuring and managing CAC and CLV can lead to more informed decision-making and improved business outcomes.

Utilize Advanced Analytics Tools

Employ analytics platforms like Google Analytics and Tableau to track and analyze customer data effectively.

Set Clear Goals and Benchmarks

Define specific targets for CAC and CLV based on industry standards and business objectives to measure progress and identify areas for improvement.

Foster a Data-Driven Culture

Encourage all departments to utilize data in their decision-making processes, ensuring that strategies are aligned with measurable outcomes.

Regularly Review and Adjust Strategies

Continuously assess the effectiveness of marketing and retention strategies, making adjustments based on data insights to optimize both CAC and CLV.

Conclusion: Balancing CAC and CLV for Sustainable Growth

Finding the right balance between Customer Acquisition Cost and Customer Lifetime Value is crucial for the success of e-commerce businesses. By focusing on reducing CAC through efficient marketing strategies and increasing CLV through exceptional customer experiences, businesses can achieve sustainable growth and enhanced profitability. Regularly measuring and optimizing these metrics ensures that e-commerce operations remain competitive and aligned with long-term business goals.