How to Choose the Right Brokerage for Your Investment Needs with Brokerage Select

Investing your hard-earned money is a significant decision, and choosing the right brokerage is crucial for a successful investment journey. With a variety of brokerages available, determining the best fit for your specific investment goals and needs can be overwhelming. In this comprehensive guide, we delve into the factors to consider when selecting a brokerage, the benefits of using Brokerage Select, and how to maximize its features and services.

Why Choosing the Right Brokerage Is Important for Your Investments

A brokerage serves as the intermediary between investors and financial markets, providing the necessary platforms and tools to buy and sell securities. The right brokerage can significantly impact the performance of your investments, the quality of your trading experience, and the level of support you receive.

For instance, the U.S. Securities and Exchange Commission (SEC) emphasizes that factors such as fees, trading tools, and customer service can influence investment outcomes. A brokerage with high fees might erode your returns, while one with robust research tools can enhance your decision-making process.

According to a study by Investopedia, investors who carefully select their brokerages based on comprehensive criteria tend to achieve better financial outcomes and higher satisfaction levels.

Understanding the Different Types of Brokerages

Brokerages come in various forms, each catering to different investment styles and needs:

- Full-Service Brokerages: Offer a wide range of services, including personalized investment advice, retirement planning, and comprehensive research tools. They are ideal for investors seeking hands-on support but come with higher fees.

- Discount Brokerages: Provide basic trading services at lower costs, suitable for self-directed investors who do not require extensive advisory services.

- Online Brokerages: Highly popular for their ease of access and efficient trading platforms. They often offer competitive fees and a variety of investment options.

- Robo-Advisors: Automated platforms that use algorithms to create and manage investment portfolios. They offer lower fees and a hands-off approach but may lack personalized advice.

Understanding these types helps in aligning your brokerage choice with your investment strategy and level of expertise.

Benefits of Using Brokerage Select for Investment Needs

Brokerage Select is an online brokerage platform designed to cater to both novice and experienced investors. Here are some of its key benefits:

- Diverse Investment Options: Offers a wide range of products, including stocks, bonds, mutual funds, and ETFs, allowing investors to build a diversified portfolio.

- Competitive Pricing: Low fees and commissions make it a cost-effective choice, potentially increasing your net returns.

- Advanced Research Tools: Provides extensive research and analysis tools to assist in making informed investment decisions.

- User-Friendly Platform: Intuitive interface that simplifies trading and portfolio management.

- Excellent Customer Support: Responsive support team available through various channels to address investor queries and concerns.

Additionally, Brokerage Select continuously updates its platform to incorporate the latest technological advancements, ensuring a seamless trading experience.

What to Consider When Choosing a Brokerage

When selecting a brokerage, several critical factors should be evaluated to ensure it aligns with your investment goals:

- Fees and Commissions: Assess the cost structure, including trading fees, account maintenance fees, and any other hidden charges.

- Investment Products: Ensure the brokerage offers the types of investments you are interested in, such as stocks, bonds, ETFs, options, or mutual funds.

- Trading Platform: Evaluate the usability, reliability, and features of the brokerage’s trading platform.

- Customer Support: Consider the quality and availability of customer service to assist you when needed.

- Security Measures: Verify the brokerage’s security protocols to protect your personal and financial information.

- Educational Resources: Availability of tutorials, webinars, and articles to enhance your investment knowledge.

Thoroughly researching these aspects will help you make an informed decision that supports your long-term financial objectives.

Examining Fees and Commission Structures of Different Brokerages

Understanding the fee structures of various brokerages is essential, as fees can significantly impact your investment returns over time. Here are some common fee structures:

- Flat-Fee Per Trade: A fixed cost for each trade executed, regardless of the trade size.

- Percentage-Based Fees: Charges based on a percentage of the trade’s value.

- Subscription Fees: Monthly or annual fees for accessing certain services or platforms.

- Account Maintenance Fees: Regular charges for maintaining your investment account.

For example, Brokerage Select offers a transparent fee structure with low commissions per trade and no account maintenance fees, making it an attractive option for cost-conscious investors. It's advisable to use tools like NerdWallet’s brokerage comparison to evaluate and compare fees across different platforms.

Factors to Consider When Selecting Investment Products Through a Brokerage

Choosing the right investment products is crucial for building a portfolio that aligns with your financial goals and risk tolerance. Consider the following factors:

- Diversification: Spread your investments across various asset classes to mitigate risks.

- Risk Tolerance: Assess your comfort level with potential losses and market volatility.

- Investment Horizon: Determine how long you plan to invest before needing the funds.

- Fees and Expenses: Be aware of any fees associated with specific investment products, such as expense ratios for mutual funds and ETFs.

- Performance History: Review the historical performance of investment products but remember that past performance is not indicative of future results.

Brokerage Select provides a wide array of investment options, along with comprehensive research tools to help you evaluate and select the best products for your portfolio.

Researching the Reputation and Credibility of Potential Brokerages

Before committing to a brokerage, it's vital to research its reputation and credibility. Consider the following steps:

- Read Reviews and Testimonials: Look for feedback from current and former clients to gauge their experiences.

- Check Regulatory Compliance: Ensure the brokerage is registered with regulatory bodies such as the SEC and is a member of the Financial Industry Regulatory Authority (FINRA).

- Assess Financial Stability: A financially stable brokerage is more likely to provide reliable services and safeguard your investments.

- Evaluate Industry Awards: Recognition from industry publications and organizations can indicate excellence in service and innovation.

Utilize resources like the Barron's Brokerage Rating to compare and contrast different brokerages based on their performance and client satisfaction.

Tips for Making the Most Out of Brokerage Select's Features and Services

To fully leverage the capabilities of Brokerage Select, consider the following tips:

- Utilize Research Tools: Take advantage of the platform’s extensive research and analysis tools to inform your investment decisions.

- Stay Informed: Use the real-time market data, news updates, and alerts available on the platform to stay abreast of market trends.

- Engage with Educational Resources: Participate in webinars, read articles, and follow tutorials to enhance your investment knowledge.

- Optimize Your Portfolio: Regularly review and rebalance your portfolio using the tools provided to ensure it remains aligned with your investment goals.

- Leverage Customer Support: Don’t hesitate to reach out to customer support for assistance or to clarify any doubts regarding your investments.

By actively engaging with these features, you can enhance your investment strategy and achieve better financial outcomes.

How to Evaluate a Brokerage's Customer Service and Support Options

Exceptional customer service can significantly enhance your investment experience. When evaluating a brokerage’s customer support, consider the following aspects:

- Availability: Look for brokerages that offer support through multiple channels such as phone, email, live chat, and social media, with extended hours if needed.

- Responsiveness: Assess how quickly and effectively the support team responds to inquiries and resolves issues.

- Expertise: Ensure that customer support representatives are knowledgeable and can provide accurate information and guidance.

- Self-Service Resources: Availability of comprehensive FAQs, tutorials, and help centers that allow you to find answers independently.

- Personalized Support: Access to dedicated account managers or financial advisors for tailored assistance.

Brokerage Select is known for its reliable and responsive customer support, offering assistance through various channels and providing extensive self-service resources to help investors navigate the platform effectively.

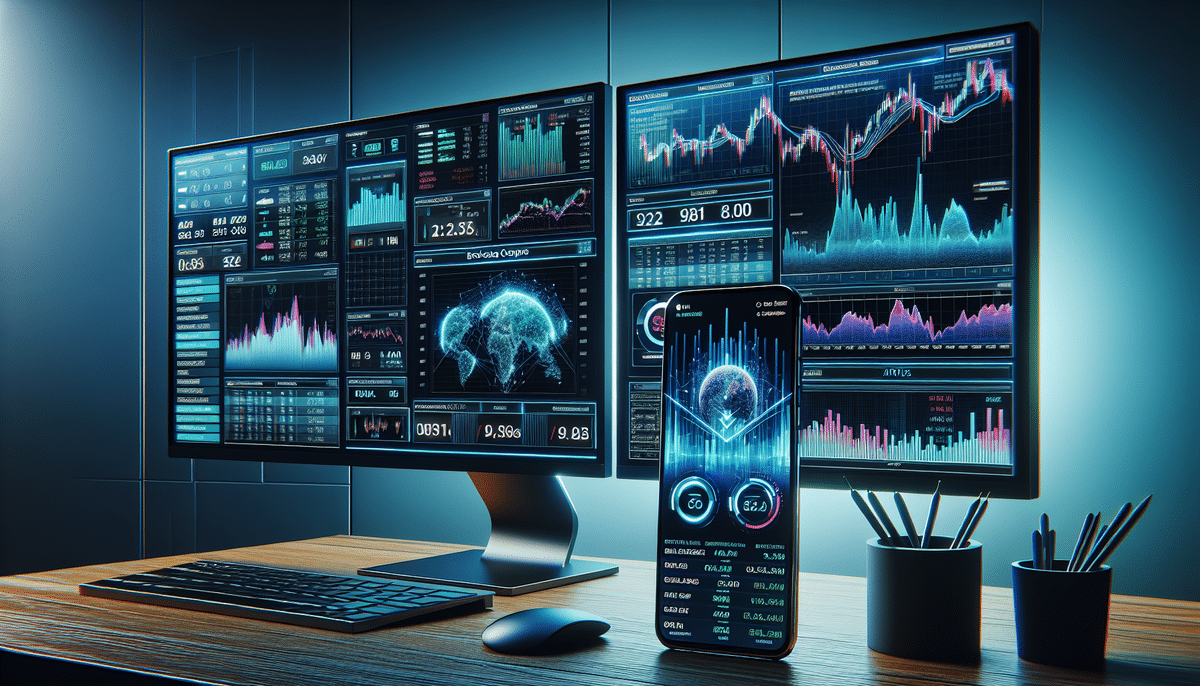

The Role of Technology in Modern Brokerages

Technology is at the forefront of modern brokerage services, enhancing the trading experience through innovative solutions:

- Advanced Trading Platforms: Feature-rich platforms with real-time data, customizable dashboards, and sophisticated charting tools empower investors to make informed decisions.

- Mobile Accessibility: Mobile apps allow investors to manage their portfolios, execute trades, and monitor market trends on the go.

- Automation and AI: Automated trading, robo-advisors, and artificial intelligence enhance efficiency and provide personalized investment strategies.

- Security Enhancements: Advanced encryption, two-factor authentication, and biometric logins ensure the safety of user data and transactions.

- Integration with Third-Party Services: Seamless integration with financial planning tools, tax software, and other third-party applications adds value to the investor’s toolkit.

Brokerage Select leverages the latest technological advancements to provide a seamless and secure trading experience, ensuring that investors have access to the tools they need to succeed in a dynamic market environment.

Comparing Brokerage Select with Other Popular Brokerage Options

When selecting a brokerage, it's beneficial to compare Brokerage Select with other leading platforms to determine the best fit for your needs:

- E*TRADE: Known for its comprehensive trading tools and extensive research resources, E*TRADE is a strong contender for active traders but comes with higher fees compared to Brokerage Select.

- TD Ameritrade: Offers a robust trading platform with excellent educational resources, making it suitable for both beginners and advanced investors. However, its fee structure may be less competitive.

- Robinhood: Popular for its commission-free trades and user-friendly mobile app, Robinhood is ideal for new investors but lacks the extensive research tools available on Brokerage Select.

- Fidelity: Renowned for its customer service and wide range of investment options, Fidelity is a great all-around brokerage but may have higher fees for certain services.

Compared to these options, Brokerage Select offers a balanced combination of low fees, diverse investment products, and strong customer support, making it a competitive choice for a wide range of investors.

Common Mistakes to Avoid When Choosing a Brokerage

Choosing the wrong brokerage can hinder your investment success. Here are some common pitfalls to avoid:

- Inadequate Research: Failing to thoroughly investigate a brokerage’s offerings, fees, and reputation can lead to suboptimal investment choices.

- Ignoring Fees: Not considering the impact of trading fees, account maintenance costs, and other charges can erode your investment returns over time.

- Lack of Diversification: Selecting a brokerage that doesn’t offer a wide range of investment products can limit your portfolio’s diversification.

- Overlooking Customer Support: Poor customer service can make resolving issues difficult, leading to frustration and potential losses.

- Impulsive Decisions: Making hasty choices based on short-term market movements rather than a well-thought-out strategy can result in unnecessary losses.

By being aware of these mistakes and taking proactive steps to avoid them, you can enhance your investment experience and achieve better financial outcomes.

The Importance of Reviewing Your Brokerage Periodically

Regularly reviewing your brokerage ensures that your investment strategies remain aligned with your financial goals. Consider the following when conducting periodic reviews:

- Fee Structure: Re-evaluate the cost-effectiveness of your brokerage’s fees and compare them with other platforms to ensure you’re getting the best deal.

- Investment Options: Assess whether your brokerage continues to offer the investment products you need for your portfolio diversification.

- Performance Metrics: Monitor the performance of your investments and the effectiveness of the brokerage’s tools and resources in supporting your strategy.

- Customer Service: Evaluate the responsiveness and helpfulness of customer support based on your recent interactions.

- Technological Updates: Stay informed about any new features or updates to the brokerage’s platform that could enhance your trading experience.

Periodic reviews help you identify areas for improvement and ensure that your brokerage continues to meet your evolving investment needs.

How to Switch from One Brokerage to Another with Ease

Transitioning from one brokerage to another can be a straightforward process if approached methodically:

- Open an Account with the New Brokerage: Begin by setting up an account with your chosen new brokerage, ensuring that it meets all your investment requirements.

- Initiate an Asset Transfer: Request a transfer of your assets from the old brokerage to the new one. Most brokerages facilitate this process through Automated Customer Account Transfer Service (ACATS).

- Complete Necessary Paperwork: Fill out any required forms or documentation to authorize the transfer.

- Monitor the Transfer Process: Keep track of the transfer status to ensure all assets are moved correctly and timely.

- Close the Old Account: Once all assets have been successfully transferred, close your old brokerage account to avoid any lingering fees or charges.

It's advisable to consult with customer support from both brokerages to address any concerns and ensure a smooth transition. Additionally, consider any tax implications, especially if transferring assets from tax-advantaged accounts like IRAs.

Conclusion

Choosing the right brokerage is critical for a successful investment journey. Brokerage Select offers a range of features and services that cater to the needs of investors, with its low fees and excellent customer support making it a competitive choice. When selecting a brokerage, consider factors such as fees, investment products, customer support, and technological capabilities. Regularly review your brokerage to ensure it continues to meet your investment goals, and don’t hesitate to switch if necessary. By making informed decisions, you can maximize your investment opportunities and achieve your financial objectives.