How to Get Post Office Insurance Coverage

Obtaining Post Office Insurance coverage is a critical step for individuals and businesses that frequently utilize postal services. Whether you're mailing documents, goods, or products, having insurance ensures that your shipments are protected against unforeseen circumstances, providing peace of mind and safeguarding against potential financial losses. This comprehensive guide delves into everything you need to know about Post Office Insurance and the steps to secure coverage for your shipments.

Why You Need Post Office Insurance

Post Office Insurance is essential for shipping valuable items or products that are susceptible to damage, loss, or theft during transit. While many postal services offer basic insurance coverage by default, this may not always suffice, especially if the value of your items exceeds the standard coverage limit. Additional insurance coverage can shield you from significant financial setbacks and alleviate the stress associated with lost or damaged shipments.

Protection Against Financial Losses

Investing in additional insurance can save you money in the long run. In the event of loss or damage, insurance allows you to file a claim and receive compensation, mitigating the need to bear the full cost of replacement or repair.

Peace of Mind for International Shipments

International shipping introduces complexities and unpredictability. With Post Office Insurance, you can rest assured that your items are protected regardless of their destination, ensuring security across borders.

Types of Post Office Insurance

Post Office Insurance offers various types tailored to different shipping needs, each providing distinct levels of coverage and protection:

- Domestic Insurance: Covers shipments within the country.

- International Insurance: Provides coverage for shipments to other countries.

- Priority Mail Express Insurance: Specifically for Priority Mail Express shipments.

- Registered Mail Insurance: Tailored for Registered Mail shipments.

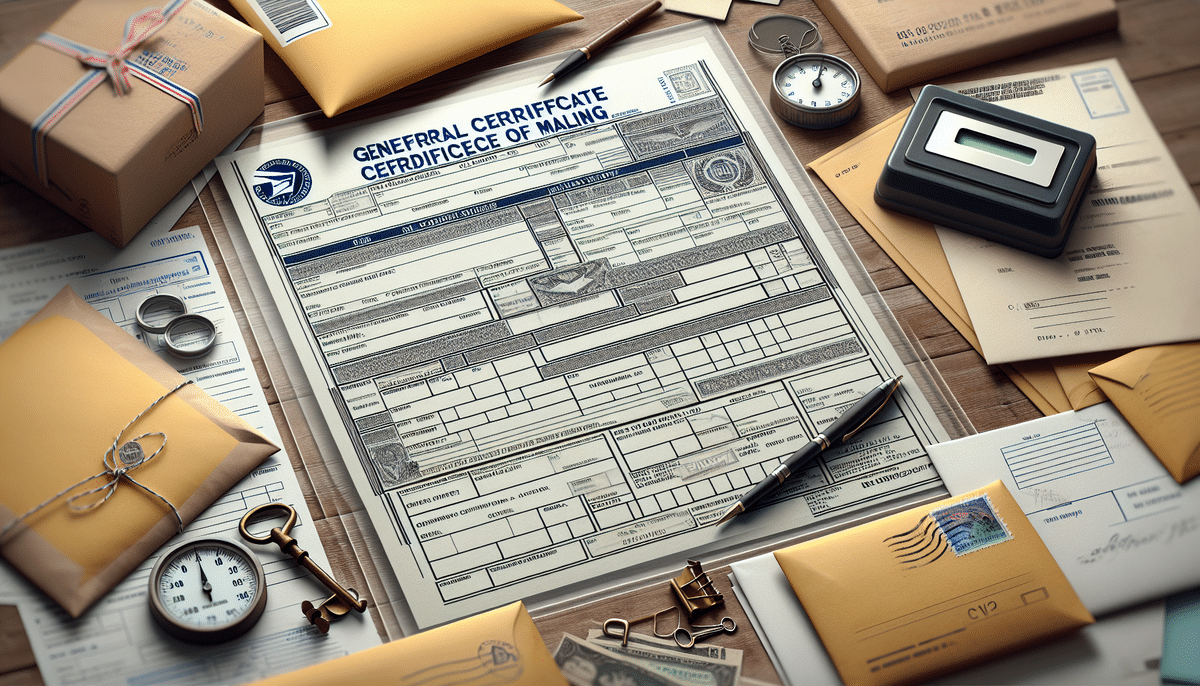

- Certificate of Mailing Insurance: Offers coverage for proof of mailing.

Each insurance type varies in coverage limits and exclusions, so it's crucial to understand the specifics before selecting a policy.

Coverage Offered by Post Office Insurance

The extent of coverage provided by Post Office Insurance depends on the chosen insurance type and the value of your shipment. Commonly covered events include:

- Loss

- Damage

- Theft

- Delay

Additionally, high-value or fragile items such as jewelry, electronics, and artwork may receive specialized coverage. It's important to review the policy's terms and conditions to understand the limitations and exclusions.

Specialized Coverage for High-Value Items

Items like jewelry, electronics, and artwork often require additional fees or special packaging to ensure their safe delivery. Consulting with a Post Office Insurance representative can help determine the best coverage options for these valuable shipments.

Comparing Insurance Rates and Providers

When selecting Post Office Insurance, it's advisable to compare rates and coverage options from various providers to find the best fit for your needs. Prominent providers include:

Rates and coverage can vary based on shipment type, value, and destination. Some providers offer discounts for frequent shippers or specific shipment categories, such as international or oversized packages.

Factors Influencing Insurance Rates

- Shipment Value: Higher-value items may require more comprehensive coverage.

- Destination: International shipments might incur different rates compared to domestic ones.

- Shipment Size and Weight: Larger and heavier packages often have varied insurance costs.

Thoroughly reviewing and understanding each provider's terms and conditions can help you make an informed decision.

How to Apply for Post Office Insurance Coverage

Applying for Post Office Insurance involves selecting the appropriate insurance type and completing the necessary forms either online or in person. Here's a step-by-step process:

- Select Insurance Type: Choose the insurance type that best fits your shipment needs.

- Provide Shipment Details: Include information such as item type, value, and any additional features like signature confirmation.

- Submit Application: Fill out and submit the relevant forms either online through the provider's website or at a postal office.

- Receive Quote and Pay Premium: After submission, you'll receive a quote and can proceed to pay the premium to finalize your coverage.

Be aware that certain items, such as hazardous materials or live animals, may be ineligible for coverage. Additionally, there may be restrictions based on the shipment's value or its destination.

Required Documentation for Claims

In the event of a claim, you'll need to provide documentation including:

- Proof of shipment value (e.g., receipts)

- Evidence of loss or damage (e.g., photographs)

- Completed claims forms

Tips for Choosing the Right Post Office Insurance Policy

Selecting the most suitable Post Office Insurance policy can be daunting. Consider the following tips to make an informed choice:

- Assess Shipment Value: Ensure the policy covers the actual value of your items.

- Understand Risks: Evaluate potential risks associated with your shipments, such as loss or damage.

- Compare Providers: Look at different providers' rates and coverage terms to find the best value.

- Read Terms and Conditions: Fully understand what is and isn't covered by the policy.

- Add Extra Features: Consider additional options like signature confirmation or proof of delivery for enhanced security.

Additionally, research the reputation and reliability of the insurance provider by reading customer reviews and ratings. Reliable customer support is also crucial for addressing any issues that may arise during the shipping process.

Common Mistakes to Avoid When Buying Post Office Insurance

Avoiding common pitfalls can ensure you obtain the most effective insurance coverage:

- Assuming Default Coverage is Sufficient: Often, the basic insurance provided may not cover high-value items.

- Underestimating Shipment Value: Failing to accurately assess the value can lead to inadequate coverage.

- Not Comparing Providers: Settling for the first provider without evaluating other options may result in higher costs or lesser coverage.

- Ignoring Policy Terms: Overlooking the fine print can lead to unexpected exclusions or limitations.

- Assuming All Items are Covered: Some items may be excluded or require special coverage.

One prevalent mistake is not thoroughly reading the policy's terms and conditions. Understanding the coverage limits, deductibles, and exclusions is essential to ensure the policy meets your needs.

How to File a Claim with Your Post Office Insurance Provider

If you experience loss or damage during transit, filing a claim promptly is crucial for receiving compensation. Follow these steps to file a claim:

- Contact the Insurance Provider: Reach out to your provider through their official website or customer service channels.

- Complete a Claims Form: Provide detailed information about the shipment and the nature of the loss or damage.

- Submit Required Documentation: Include proof of shipment value, evidence of damage, and any other necessary documents.

- Follow Up: Stay in touch with the provider to monitor the status of your claim and provide any additional information if needed.

The claims process may take several weeks, so it's important to maintain all relevant documentation and communicate effectively with your insurance provider to ensure a smooth resolution.

Conclusion

Securing Post Office Insurance coverage is vital for protecting your shipments against potential losses or damages. By understanding the various types of insurance available, comparing rates and providers, and selecting the right policy, you can ensure that your shipments are well-protected. Remember to carefully review policy terms, accurately assess shipment values, and avoid common mistakes to make the most of your insurance coverage.

Always package your items securely to prevent damage during transit and keep detailed records of your shipments. This proactive approach, combined with adequate insurance, will help safeguard your valuable items and provide peace of mind throughout the shipping process.