How to Insure Your Package When Using FedEx Ship Manager

Sending a package via FedEx is an efficient way to ensure your goods reach their destination swiftly and securely. However, safeguarding your shipment against potential loss or damage during transit is crucial. This guide will walk you through the process of insuring your package with FedEx Ship Manager, covering various insurance options, valuing your package, selecting appropriate coverage, adding insurance to your shipment, and filing a claim if necessary.

Why You Need Insurance for Your Package

Shipping goods inherently carries risks, including weather-related delays, theft, damage, and loss. Without insurance, you could face significant financial losses if any of these events occur. Insurance not only provides financial protection but also offers peace of mind, ensuring that unforeseen incidents during transit do not derail your business or personal endeavors.

- Financial Protection: Insurance covers the cost of lost or damaged goods, preventing out-of-pocket expenses.

- Legal Safeguard: In case of disputes over lost or damaged items, insurance can mediate and resolve issues efficiently.

- Customer Trust: Offering insurance options demonstrates your commitment to safe and reliable shipping, enhancing your reputation and customer loyalty.

According to the FedEx 2023 Annual Report, the global shipping industry continues to grow, making package insurance an essential service for both businesses and individual shippers.

Understanding Insurance Options Available in FedEx Ship Manager

FedEx Ship Manager provides various insurance options tailored to the value and nature of your shipment:

- Declared Value Coverage: Standard protection included with FedEx services, offering limited liability based on package weight, up to $100 per package.

- Declared Value Coverage for High-Value Items: Additional coverage for valuable items like jewelry, artwork, or electronics, with higher liability limits.

- Package Insurance: Optional comprehensive coverage for loss, damage, or theft, covering the full value of the shipment up to $50,000 per package.

For more detailed information, visit the FedEx Ship Manager page.

Calculating the Value of Your Package for Insurance

Accurately determining the value of your shipment is essential for selecting the appropriate insurance coverage. Here's how to calculate it:

- Total Cost: Sum the cost of goods, including taxes, duties, and additional fees.

- Market Value: Assess the current market value or replacement cost of the items in case of loss or damage.

Maintaining detailed records, such as invoices and receipts, is crucial for substantiating the value of your shipment when filing a claim.

Be aware that some insurance policies have maximum coverage limits. In such cases, consider purchasing additional coverage or alternative insurance options to fully protect your shipment.

Tips for Choosing the Right Insurance Coverage

Assessing Shipment Value and Fragility

Consider the monetary value and fragility of your items. High-value or delicate items may require enhanced coverage to ensure comprehensive protection.

Understanding Destination Restrictions

Some countries impose limitations on insurance types and amounts. Verify any restrictions for your shipment's destination to select compatible coverage.

Reviewing Terms and Conditions

Carefully examine the insurance policy's terms, including deductibles and exclusions, to understand your coverage fully.

Considering Transportation Mode

The risk level varies with different transportation modes. For instance, air shipments might be susceptible to pressure changes, while sea shipments could face saltwater damage. Ensure your insurance matches the transportation mode chosen.

Step-by-Step Guide to Adding Insurance to Your FedEx Shipment

Incorporating insurance into your FedEx shipment is simple through the FedEx Ship Manager:

- Log in to your FedEx account and select "Prepare Shipment".

- Input shipment details, including recipient address, shipment date, package weight, and dimensions.

- Select the insurance option that aligns with your shipment's value and nature.

- Enter the declared value of the shipment along with any additional required information.

- Review and confirm all shipment details, ensuring insurance coverage is correctly applied.

- Print the shipping label and affix it securely to your package.

Note that insurance costs vary based on shipment value and selected coverage level. While FedEx includes insurance coverage up to $100 for free, additional coverage incurs extra fees.

Keep copies of your shipping label and insurance documentation to facilitate any future claims.

What to Do if Your Insured Package Is Lost or Damaged in Transit

If your package is lost or damaged during transit, follow these steps to file a claim with FedEx:

- Notify FedEx: Contact FedEx promptly to report the issue.

- Gather Documentation: Compile proof of shipment value, itemized lists of lost or damaged items, shipping labels, invoices, and receipts.

- Submit a Claim: File the claim online, by phone, or at a FedEx location, providing all necessary documentation.

- Follow Up: Monitor the status of your claim and respond to any additional information requests from FedEx.

Be aware that compensation may not always cover the full value of your items due to policy limitations, deductibles, or exclusions. Review the insurance policy terms to understand the extent of your coverage.

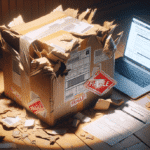

Implement preventive measures, such as using sturdy packaging materials, double-boxing fragile items, proper labeling, and selecting reliable shipping services with tracking and insurance options, to minimize the risk of loss or damage.

Common Mistakes to Avoid When Insuring Your FedEx Shipment

Avoid these pitfalls to ensure effective insurance coverage for your shipments:

- Underestimating Shipment Value: Accurately assess and declare the full value of your goods to prevent insufficient coverage.

- Neglecting High-Value Items: Declare all high-value items to qualify for appropriate coverage levels.

- Poor Packaging: Even with insurance, inadequate packaging can lead to damage that may not be covered.

- Lack of Documentation: Keep detailed records and receipts to support any insurance claims.

Properly packaging your items using materials like bubble wrap or packing peanuts and securely sealing the package can significantly reduce the risk of damage during transit.

How to File an Insurance Claim with FedEx

Filing an insurance claim with FedEx involves several steps to ensure a smooth process:

- Access the Claims Portal: Visit the FedEx Claims page.

- Provide Shipment Details: Enter the tracking number, shipment date, and declared value.

- Submit Documentation: Upload necessary documents such as invoices, receipts, and photos of the damage.

- Review and Submit: Confirm all information is accurate and submit your claim.

After submission, you will receive a claim number for tracking purposes. FedEx will review your case and may request additional information. The claims process can take several weeks, depending on complexity and documentation provided. If approved, compensation will be issued based on your declared value and coverage terms.

Ensure all information provided is accurate and complete to avoid delays in the claims process.

Alternatives to FedEx Insurance: Exploring Other Options for Package Protection

While FedEx offers robust insurance options, exploring other carriers and third-party providers can help you find the best coverage for your needs:

- UPS: Offers similar insurance options with varying coverage limits. Visit the UPS Insurance page for more details.

- USPS: Provides insurance through services like Priority Mail and Priority Mail Express. Learn more on the USPS Insurance page.

- Third-Party Insurance: Companies like Insureon offer specialized shipping insurance policies that may provide more comprehensive coverage.

Additionally, some credit card companies include package protection as a benefit. Review your credit card's terms to determine if this coverage meets your shipping protection needs.

Comparing different insurance options based on coverage limits, premiums, deductibles, and terms will help you choose the best protection for your shipments.

In conclusion, insuring your FedEx shipment is a proactive step towards ensuring the safety and financial security of your goods during transit. By understanding the available insurance options, accurately valuing your shipment, selecting appropriate coverage, and knowing how to file a claim, you can confidently ship your packages knowing they are well-protected.