Understanding the Importance of Customer Retention in Business

Customer retention is a critical factor in determining the long-term success of any business. According to a study by Bain & Company, increasing customer retention rates by just 5% can boost profits by 25% to 95%. Companies often focus heavily on acquiring new customers, which can be up to five times more expensive than retaining existing ones. Loyal customers not only provide recurring revenue but also advocate for the business, enhancing its reputation and reducing marketing costs. Additionally, customer retention is a key indicator of overall customer satisfaction, reflecting the effectiveness of a company's products, services, and customer engagement strategies.

Gathering and Preparing Customer Data for Effective Retention Analysis

The foundation of any customer retention analysis is accurate and comprehensive customer data. This data can be sourced from various channels including CRM systems, transaction records, social media interactions, and customer surveys. Importing this data into Excel requires careful organization to ensure each row represents a unique customer and each column represents key attributes such as demographics, purchase history, and engagement metrics.

Before analysis, it is essential to clean and validate the data. This process involves removing duplicates, correcting errors, and ensuring data consistency. Clean data is crucial for reliable analysis results, enabling businesses to uncover true patterns in customer behavior. Utilizing Excel’s built-in data validation and error-checking tools can enhance the accuracy and reliability of your dataset.

Identifying and Measuring Key Retention Metrics

To effectively analyze customer retention, businesses must identify key metrics that reflect customer loyalty and business health. Common retention metrics include:

- Customer Churn Rate: The percentage of customers who stop using a company's product or service over a given period.

- Customer Lifetime Value (CLV): The total revenue a business can reasonably expect from a single customer account throughout the business relationship.

- Customer Engagement Rate: A measure of how actively customers interact with a company's products, services, and communications.

- Net Promoter Score (NPS): A metric that gauges customer satisfaction and loyalty by asking customers how likely they are to recommend the company to others.

These metrics can be calculated using Excel functions such as COUNTIF, SUMIF, and AVERAGE. Selecting the right metrics depends on the industry and specific business goals. Regular tracking and analysis of these metrics enable businesses to monitor the effectiveness of their retention strategies and make data-driven decisions.

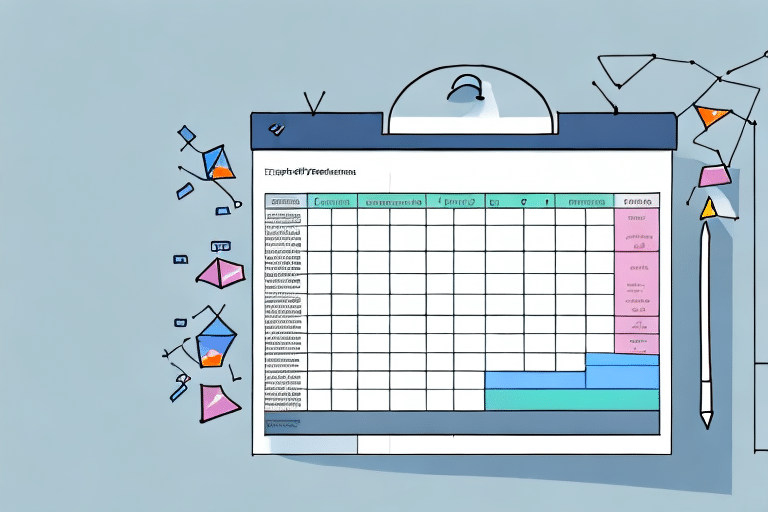

Analyzing Customer Retention Data Using Excel Tools

Excel offers a range of tools that facilitate the analysis of customer retention data. Key features include:

Pivot Tables for Data Summarization

Pivot tables allow users to quickly summarize large datasets, making it easier to identify trends and patterns in customer behavior. For instance, businesses can group data by customer demographics or purchase history to calculate average CLV or churn rates. This helps in segmenting customers and identifying which groups are more likely to remain loyal.

Charts and Graphs for Data Visualization

Visual representations such as bar charts, line graphs, and pie charts help in understanding complex data. Excel's charting tools can be used to create visualizations that highlight key retention trends, making it easier to communicate findings to stakeholders. Visual data aids in quickly identifying peaks, troughs, and patterns that may require strategic adjustments.

Statistical Functions for Predictive Analysis

Excel's statistical functions like LINEST and TREND support predictive modeling. Businesses can forecast future retention rates based on historical data, enabling them to develop proactive retention strategies. Predictive analysis helps in anticipating customer behavior and preparing strategies to address potential churn before it occurs.

Advanced Analysis Techniques: Cohort Analysis and Lifetime Value Calculation

Deepening retention analysis involves advanced techniques such as cohort analysis and calculating customer lifetime value (CLV).

Cohort Analysis to Track Customer Behavior Over Time

Cohort analysis groups customers based on shared attributes, such as the month of their first purchase, to track their behavior over time. This method helps businesses identify patterns and factors that influence customer loyalty and retention. For example, analyzing cohorts can reveal whether customers acquired during a promotional campaign exhibit different retention rates compared to those acquired through organic channels.

Calculating Customer Lifetime Value (CLV)

CLV estimates the total revenue a business can expect from a customer over their entire relationship. By calculating CLV in Excel, companies can identify high-value customers and tailor marketing efforts to maximize their retention. A higher CLV indicates greater customer loyalty and long-term profitability. Understanding CLV also aids in allocating marketing resources more efficiently, focusing on retaining customers who contribute the most to revenue.

Developing and Implementing Effective Customer Retention Strategies

Based on the insights gained from retention analysis, businesses can develop targeted strategies to enhance customer loyalty. Key strategies include:

- Personalized Marketing: Tailoring marketing messages to individual customer preferences and behaviors to increase engagement and satisfaction.

- Improving Customer Service: Ensuring responsive and high-quality customer support to address issues promptly and enhance the overall customer experience.

- Loyalty Programs: Implementing programs that reward repeat customers, encouraging continued business and fostering loyalty.

- Product or Service Enhancements: Continuously improving offerings based on customer feedback to meet evolving needs and expectations.

Implementing these strategies requires coordination across various departments and continuous monitoring to assess their effectiveness. Regularly revisiting and refining retention strategies ensures they remain aligned with changing customer needs and market conditions.

Best Practices and Common Pitfalls in Customer Retention Analysis

Conducting a customer retention analysis in Excel can yield valuable insights, but businesses must be aware of common pitfalls to ensure accurate and actionable results.

Best Practices

- Ensure Data Accuracy: Regularly update and validate customer data to maintain its reliability.

- Use Appropriate Metrics: Select metrics that align with business goals and provide meaningful insights into customer behavior.

- Visualize Data Effectively: Utilize charts and graphs to make data accessible and understandable to all stakeholders.

- Collaborate Across Departments: Share insights with all relevant teams to ensure a coordinated approach to retention efforts.

Common Pitfalls to Avoid

- Relying on Incomplete Data: Inadequate data can lead to inaccurate analysis and misguided strategies.

- Overlooking External Factors: Factors such as market trends and economic conditions can impact customer behavior and should be considered in the analysis.

- Failing to Act on Insights: Collecting data without taking action can render the analysis efforts ineffective.

- Ignoring Data Privacy: Ensure that customer data is handled in compliance with privacy regulations to avoid legal issues.

Case Studies: Successful Customer Retention Analysis Using Excel

Numerous companies have leveraged Excel to conduct effective customer retention analysis, leading to improved loyalty and increased revenues.

Amazon: Utilizing Cohort Analysis in Excel

Amazon employs cohort analysis to track customer behavior over time, allowing them to identify key factors that drive repeat purchases. This insight enables Amazon to tailor their marketing strategies to specific customer groups, enhancing retention rates.

Netflix: Tracking Customer Engagement and Retention

Netflix uses Excel to monitor customer engagement metrics and retention rates. By analyzing this data, Netflix can identify content preferences and adjust their offerings to meet customer demands, ensuring high levels of satisfaction and loyalty.

Starbucks: Analyzing Customer Feedback for Retention

Starbucks utilizes Excel to analyze customer feedback, identifying areas for improvement in their products and services. This proactive approach helps Starbucks maintain a strong connection with their customers, fostering long-term loyalty.

Nike: Calculating CLV and Churn Rates

Nike calculates customer lifetime value and churn rates using Excel to understand the long-term profitability of their customers. This analysis informs Nike's retention strategies, focusing on high-value customers to drive sustained growth.

Key Takeaways for Conducting Effective Customer Retention Analysis in Excel

Performing a customer retention analysis using Excel is a vital practice for enhancing business success. The key takeaways from this process include:

- Data-Driven Insights: Accurate data collection and analysis provide valuable insights into customer behavior and retention patterns.

- Relevant Metrics: Identifying and measuring the right retention metrics, such as CLV and churn rate, is essential for effective analysis.

- Effective Use of Excel Tools: Leveraging Excel's pivot tables, charts, and statistical functions facilitates comprehensive data analysis and visualization.

- Targeted Retention Strategies: Developing customized strategies based on analysis results can significantly improve customer loyalty and business profitability.

- Continuous Monitoring: Regularly tracking and analyzing retention metrics ensures ongoing effectiveness of retention efforts and allows for timely adjustments.

By implementing these practices, businesses can successfully retain their loyal customer base, drive sustained revenue growth, and achieve long-term success.