Making Peak Spending Easier: How New Technologies Are Changing the Way We Pay

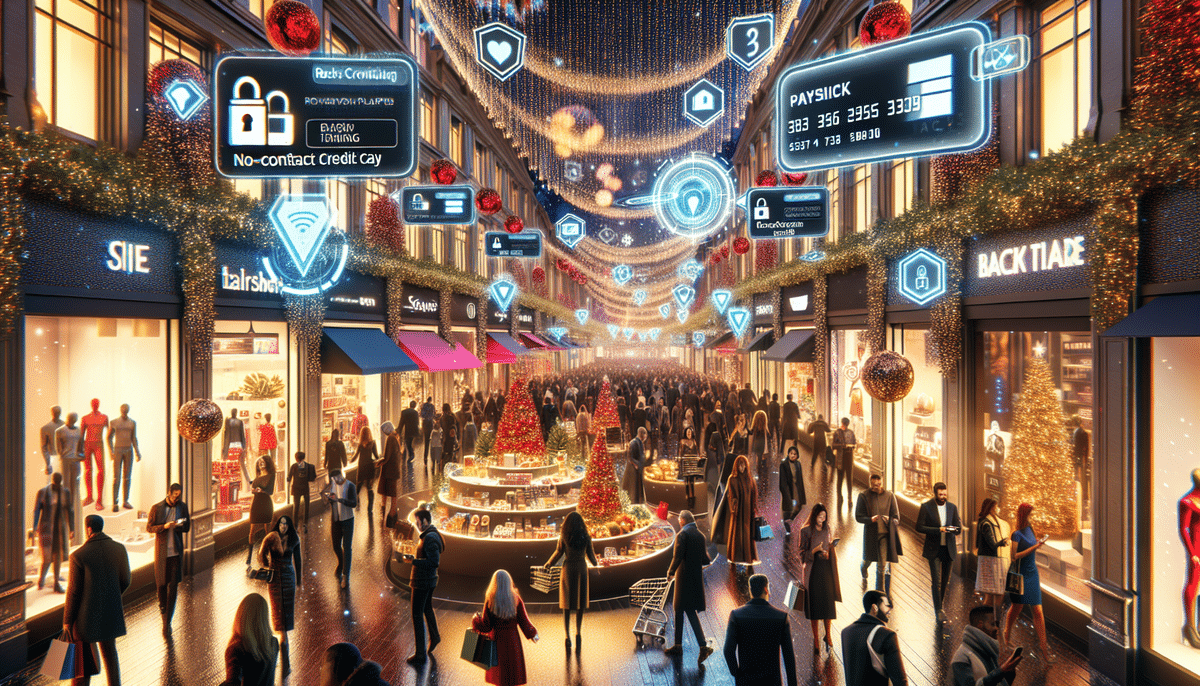

Managing expenses during peak spending periods, such as holiday seasons or major sales events, can be challenging. However, advancements in payment technologies have made it easier to navigate these times. This article explores the evolution of payment technologies, their impact on peak spending, and strategies to maximize savings during these periods.

The Evolution and Impact of Payment Technologies

Over the past few decades, payment technologies have undergone significant transformations. The reliance on cash and checks has diminished, giving way to credit and debit cards, contactless payments, mobile payment apps, and digital wallets.

These innovations have revolutionized transactions by making them faster and more convenient, while also altering how consumers manage their finances. According to a 2023 Mobile Payment Adoption Report, the use of mobile payments increased by 25% compared to the previous year.

One significant effect of these technologies is on peak spending behaviors. The ease of making payments often leads to increased impulse purchases and higher overall spending. However, real-time tracking through mobile apps and digital wallets also empowers consumers to stay within their budgets and avoid overspending. It's crucial to remain vigilant against potential risks like fraud and identity theft, which necessitate robust protection of financial information.

Key Technologies Enhancing Peak Spending Management

Contactless Payments

Contactless payments have surged in popularity due to their speed, security, and convenience. During peak spending periods, they are especially beneficial by reducing transaction times and minimizing checkout queues.

Enhanced security features, such as tokenization, protect card details during transactions. According to a FBI Fraud Prevention Report 2023, contactless payment systems have seen a 40% reduction in fraud incidents compared to traditional card payments.

Additionally, contactless payments facilitate real-time spending tracking through mobile banking apps or online portals, enabling consumers to monitor their expenditures effortlessly during fast-paced shopping periods.

Mobile Payment Apps

Mobile payment apps have become essential tools for consumers aiming to manage their finances effectively. These apps offer features like budgeting goals, expense tracking, and alerts for spending limits.

During peak spending times, mobile payment apps provide real-time expense updates and often include exclusive discounts and incentives. A study by Nielsen's Mobile Payment Benefits Report revealed that users of mobile payment apps saved an average of 15% more during holiday seasons compared to non-users.

Furthermore, the ability to split expenses with friends or family through these apps is particularly useful during group activities or holiday gatherings, helping to manage collective spending efficiently.

Digital Wallets

Digital wallets represent a significant innovation in payment technologies, allowing users to store payment details securely and make purchases using smartphones across various platforms.

During peak spending periods, digital wallets offer features such as cashback rewards and integrated loyalty programs, which help consumers save money on their purchases. According to a Statista Digital Wallet Usage Report 2023, digital wallet users reported a 20% increase in reward points accumulation during peak seasons.

Moreover, digital wallets expedite the payment process, reducing wait times in line and minimizing physical contact, which enhances overall shopping efficiency and safety.

Security Concerns and Measures

Despite their numerous benefits, new payment technologies come with inherent security risks. Concerns about data breaches and fraudulent activities can make some consumers hesitant to adopt these methods.

However, most modern payment systems incorporate advanced security measures like encryption and tokenization to safeguard user data. The Federal Trade Commission on Protecting Personal Information emphasizes the importance of using strong passwords and enabling two-factor authentication to further protect financial information.

Fraud remains a significant concern as payment methods evolve. Criminals continually develop sophisticated techniques, such as phishing and malware, to exploit vulnerabilities. Staying informed about the latest security threats and adopting best practices is essential for both consumers and businesses.

Maximizing Savings with Cashback and Rewards Programs

Cashback and rewards programs are effective tools for consumers looking to save money during peak spending periods. These programs offer incentives like cashback, points, or discounts when purchases are made through specific payment methods or retailers.

During high-traffic shopping periods, these programs not only provide savings but also help consumers track their spending and make informed purchasing decisions. A Forbes Rewards Analytics Report indicates that consumers using rewards programs spend 10% less on average during peak seasons.

Additionally, many rewards programs feature special promotions or bonuses during peak times, such as extra cashback during the holiday season or bonus points on Black Friday purchases, further enhancing savings opportunities.

Future Trends in Payment Technologies

The future of payment technologies is promising, with continuous innovations set to further simplify managing peak spending. Biometric authentication methods, such as facial recognition and fingerprint scanning, are becoming standard, offering enhanced security and user convenience.

Blockchain-based payment systems are another emerging trend, providing increased security, transparency, faster transactions, and lower fees. As adoption grows, these systems are expected to significantly alter financial transactions.

Integration with other financial tools, such as budgeting apps and investment platforms, is also on the horizon. This seamless integration will allow users to manage their finances holistically, consolidating all financial information in one place for better oversight and control.

Strategies for Consumers to Maximize Savings During Peak Spending Periods

To fully leverage new payment technologies during peak spending periods, consumers can adopt several strategies:

- Utilize Contactless Payments or Digital Wallets: Speed up transactions and reduce wait times.

- Employ Mobile Payment Apps: Track expenses and receive alerts when nearing spending limits.

- Take Advantage of Cashback and Rewards Programs: Save money on purchases through incentives.

- Enhance Security Measures: Use strong passwords and enable two-factor authentication to protect payment details.

- Compare Prices and Shop Around: Use price comparison tools to find the best deals.

- Consider Installment Payments: Spread the cost of purchases over time to manage finances better.

Implementing these strategies allows consumers to make the most of payment technologies, ensuring effective financial management and maximizing savings during peak spending periods.

Conclusion

New payment technologies are revolutionizing how we manage finances, especially during peak spending periods. By offering fast, secure, and convenient payment options, these technologies help consumers track expenses, make informed purchasing decisions, and save money.

As payment technologies continue to advance, managing peak spending will become even more streamlined. Embracing these innovations and applying smart financial strategies can lead to significant savings and a more stress-free shopping experience.

One of the most exciting developments is the rise of mobile payments. With smartphones widely adopted, consumers can now make payments at points of sale without the need for physical cards or cash. Mobile payment apps like Apple Pay and Google Wallet provide secure and convenient payment methods, with many retailers now accepting these forms of payment. As mobile payments grow in popularity, we can anticipate even more innovative features that will further simplify financial management.