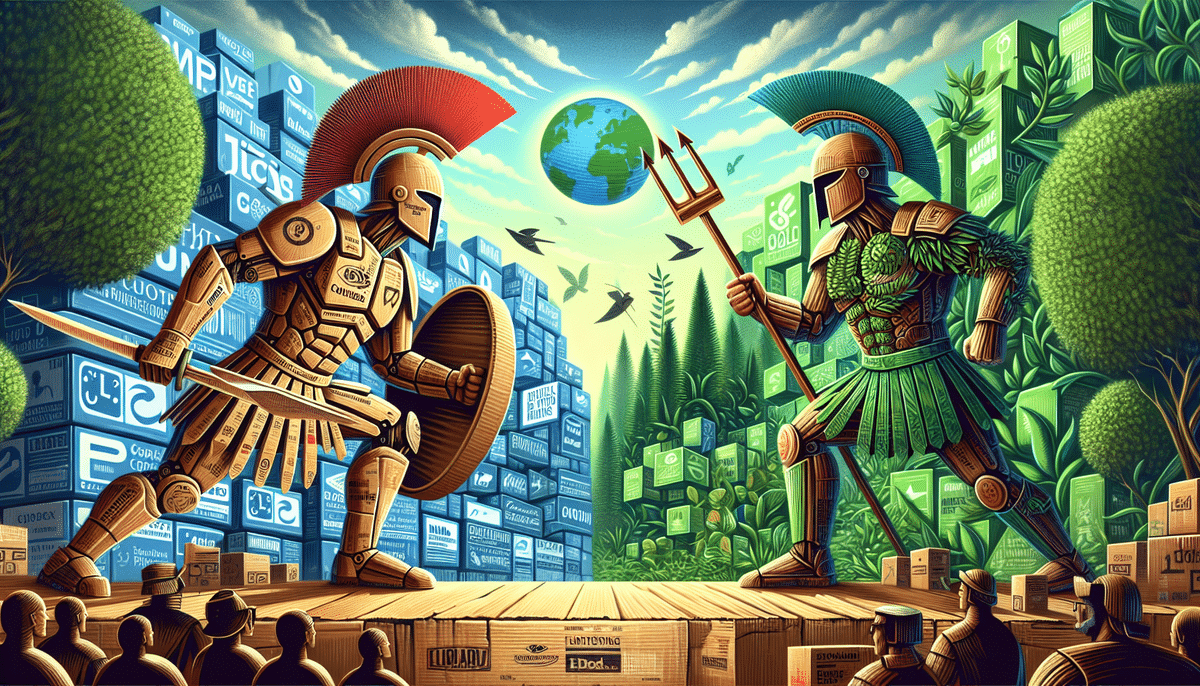

Introduction to the Packaging Industry: PCA vs. International Paper

The packaging industry is a cornerstone of the global economy, with key players driving innovation, sustainability, and market growth. Among the prominent companies in this sector are Packaging Corporation of America (PCA) and International Paper (IP). Both have established themselves as leaders, but how do they compare in terms of market positioning, financial performance, and sustainability? This article provides an in-depth analysis to determine which company is better positioned for future growth.

Company Overviews

Packaging Corporation of America (PCA)

Founded in 1959 and headquartered in Lake Forest, Illinois, Packaging Corporation of America (PCA) specializes in the manufacturing and distribution of containerboard and corrugated packaging. With over 120 facilities across 47 U.S. states and a workforce of more than 15,000 employees, PCA serves diverse industries such as food and beverage, e-commerce, and agriculture.

PCA is dedicated to sustainability, investing in renewable energy sources like biomass and hydroelectric power, and utilizing recycled materials in its products. The company's focus on energy-efficient technologies has significantly reduced its environmental footprint.

International Paper (IP)

International Paper (IP), established in 1898 and based in Memphis, Tennessee, operates globally with over 300 manufacturing facilities across North America, Europe, Asia, and Latin America. IP produces a wide range of paper and packaging products, including pulp and tissue, serving industries like healthcare, food and beverage, and printing.

International Paper emphasizes sustainability, aiming to reduce its greenhouse gas emissions by 20% by 2030. The company practices sustainable forestry, including reforestation and responsible wood sourcing, to ensure the longevity of its raw material supplies.

Market Share and Financial Performance

Market Share Comparison

In terms of market share, International Paper holds a significant lead with a 2019 revenue exceeding $22 billion compared to PCA's $7 billion. IP's market capitalization stands at approximately $18 billion, double that of PCA's $9 billion.

Despite this, PCA has demonstrated robust growth, increasing its revenue by over 20% since 2016, reaching $7 billion. This growth is largely driven by its innovative sustainable packaging solutions and expansion into emerging markets in Asia and South America.

Financial Performance Analysis

Analyzing the financial metrics reveals that both companies are performing well, but with different strengths. In 2020, PCA reported a 7% increase in revenue, while IP saw a 4% rise. IP's net income surpassed $1 billion, whereas PCA's net income was slightly over $400 million. However, PCA boasts a higher return on equity (ROE) of 21.4% compared to IP's 16.2%, indicating a stronger financial efficiency.

The COVID-19 pandemic impacted both companies, but PCA's focus on packaging—a sector that experienced increased demand—provided a buffer against disruptions faced by IP's more diversified portfolio.

Product Offerings and Innovation

Diverse Product Portfolios

Both PCA and IP offer extensive product lines, including containerboard and corrugated packaging. However, IP also manufactures paper products such as printing paper and envelopes, which PCA does not produce. PCA leads in the containerboard and corrugated packaging market, holding a larger market share in these segments.

Innovation in Packaging Solutions

PCA has been at the forefront of packaging innovation, introducing lightweight packaging that reduces shipping costs and enhances sustainability. Additionally, PCA has developed specialized packaging solutions tailored for the booming e-commerce sector.

International Paper continues to innovate by investing in new technologies to enhance manufacturing efficiency and exploring alternative sustainable materials to meet evolving market demands.

Sustainability Practices

PCA's Sustainability Initiatives

PCA is committed to sustainability, utilizing 100% recycled fiber in its containerboard and corrugated packaging. The company invests in renewable energy sources such as solar, wind, and hydroelectric power to minimize its carbon footprint. PCA also aims for zero waste to landfill across all its facilities.

International Paper's Sustainability Efforts

International Paper focuses on sustainable forestry and aims to source 100% of its wood fiber from certified sustainable sources. The company has set a target to reduce greenhouse gas emissions by 20% by 2030 and is actively involved in reforestation and responsible wood sourcing practices.

Both companies engage in community outreach and education programs to promote sustainability, partnering with local organizations and supporting environmental conservation efforts.

Corporate Social Responsibility (CSR) Initiatives

PCA's CSR Programs

PCA emphasizes sustainable packaging solutions and has invested in renewable energy to power its facilities. The company collaborates with local organizations to support recycling initiatives and environmental education programs.

International Paper's CSR Commitments

International Paper is dedicated to promoting sustainable forestry practices and reducing its greenhouse gas emissions. The company also focuses on diversity and inclusion, encouraging employee volunteering and supporting various charitable initiatives related to education and disaster relief.

Future Growth Potential and Expert Insights

Industry experts predict continued growth in the packaging sector, particularly in sustainable solutions. PCA is well-positioned to capitalize on this trend due to its strong market presence in containerboard and corrugated packaging and its investment in sustainable practices. On the other hand, International Paper's diverse product range and global footprint provide it with the flexibility to adapt to market changes, although its focus on paper products may require strategic adjustments to align with sustainability trends.

The future growth of both companies will depend on their ability to innovate and respond to the increasing demand for environmentally responsible packaging solutions.

Conclusion: Which Company Leads the Pack?

Both Packaging Corporation of America and International Paper possess significant strengths that position them well within the packaging industry. PCA excels in containerboard and corrugated packaging with a strong commitment to sustainability, while IP offers a diverse product range and extensive global operations. PCA's higher return on equity and focused growth in sustainable packaging present a robust case for its future growth potential. Conversely, IP's financial strength and global presence provide it with resilience and adaptability. The ultimate leader will be determined by how each company navigates the evolving market demands and sustainability challenges in the coming years.