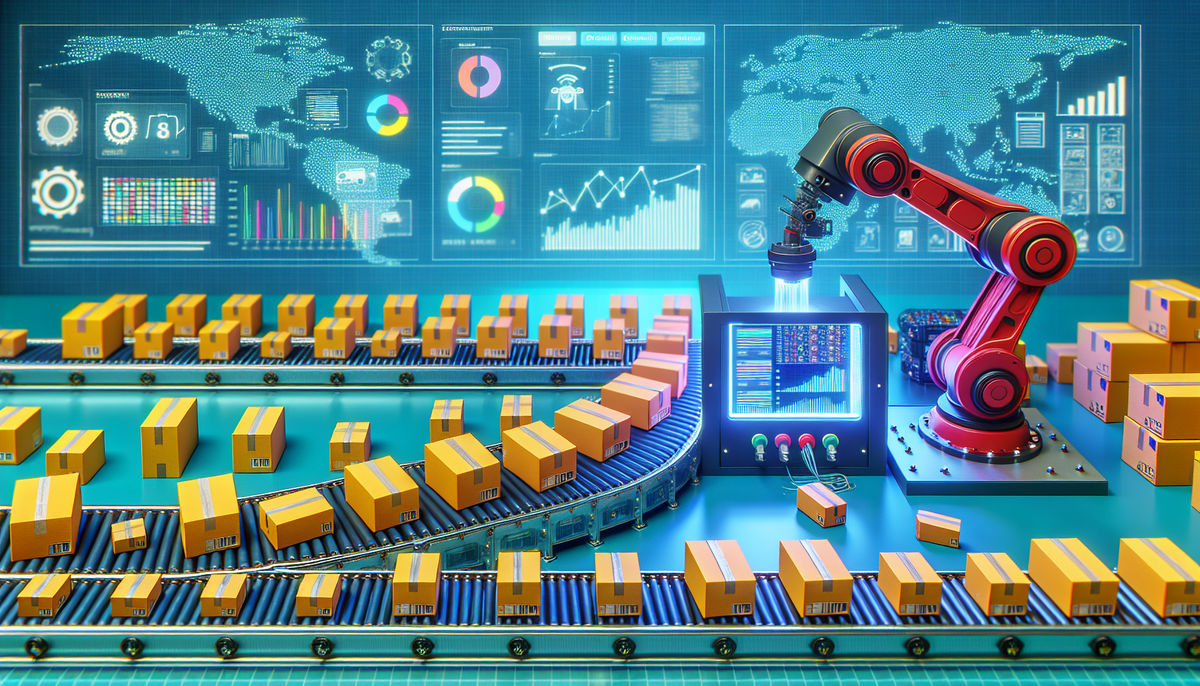

Parcel Bill Audit and Payment Services: A Comprehensive Guide

If you're a business owner or manager who regularly ships goods, you're likely familiar with the challenges of parcel billing. It's an essential process, yet it can be complex and time-consuming. Fortunately, parcel bill audit and payment services can help streamline the process and save businesses significant amounts of money. In this article, we'll provide an in-depth guide to these services, covering everything from the basics to best practices and future trends.

Understanding the Basics of Parcel Bill Audit and Payment Services

Parcel bill audit and payment services are third-party solutions that audit and pay parcel carrier bills on behalf of businesses. These services leverage advanced technology and skilled professionals to analyze your shipping data, ensuring that you're not overpaying for shipping services.

Unlike traditional freight audit services that focus on larger freight carriers, parcel bill audit services specialize in small parcel carriers like FedEx, UPS, and DHL. These carriers often have intricate pricing structures, numerous surcharges, and complex contracts, making accurate bill auditing a challenge for businesses.

Parcel bill payment services handle the actual payment of carrier bills, typically offering consolidated billing. This means businesses receive a single invoice for all carriers, simplifying accounting processes and saving valuable time.

Moreover, these services provide insightful data analysis on your shipping patterns and costs. By identifying areas where you can save money and optimize your shipping processes, such as recommending different carriers for specific shipments or adjusting packaging to reduce dimensional weight charges, businesses can enhance their overall efficiency.

The Importance of Parcel Bill Audit and Payment Services for Businesses

Parcel bill audit and payment services are crucial for businesses aiming to optimize their shipping processes and reduce costs. By analyzing shipping data and pinpointing areas for improvement, these services can help businesses reduce their shipping expenses by up to 25%.1

Beyond cost savings, these services enhance shipping accuracy and prevent billing errors, minimizing disputes with carriers and ensuring that businesses receive the services they pay for.

Outsourcing these tasks also allows businesses to free up valuable time and resources, enabling them to focus on core activities like product development and customer service.

Additionally, parcel bill audit and payment services offer detailed insights into shipping patterns and trends. By analyzing data on shipping volumes, destinations, and carrier performance, businesses can make informed decisions about their shipping strategies and negotiate better rates with carriers, maintaining a competitive edge in their industry.

How Parcel Bill Audit and Payment Services Help Businesses Save Money

These services employ various methods to help businesses save money on shipping, including:

- Identifying Billing Errors and Overcharges: Detecting and correcting mistakes can save businesses up to 5% on shipping costs.

- Negotiating Better Rates with Carriers: Securing improved rates can lead to savings between 3% and 15%.

- Optimizing Shipping Routes and Methods: Efficient routing can save businesses up to 25% on shipping expenses.

- Identifying Opportunities to Use Less Expensive Carriers: Selecting more cost-effective carriers for specific shipments can further reduce costs.

In addition to cost-saving tactics, parcel bill audit and payment services provide valuable data and insights. Analyzing shipping data helps businesses identify trends and patterns, enabling them to make strategic decisions about shipping strategies and carrier selection.

Furthermore, these services streamline shipping processes by handling the auditing and payment of shipping bills, increasing operational efficiency and productivity.

Key Benefits of Outsourcing Parcel Bill Audit and Payment Services

Outsourcing parcel bill audit and payment services offers numerous advantages over handling these tasks in-house:

- Expertise: Service providers possess specialized knowledge in the shipping industry, identifying improvement areas and recommending effective solutions.

- Focus: Businesses can concentrate on core activities instead of administrative tasks related to billing and payments.

- Cost Savings: Significant savings can be realized through error detection, rate negotiations, and process optimizations.

- Automation: Advanced technology automates auditing and payment processes, enhancing accuracy and reducing human error.

Additionally, outsourcing provides access to real-time data and analytics. Providers offer detailed reports and insights into shipping expenses, allowing businesses to make informed decisions and optimize shipping strategies.

Outsourcing also offers greater flexibility and scalability. As shipping needs evolve, businesses can easily adjust their service agreements without investing in additional resources or technology.

Factors to Consider When Choosing a Parcel Bill Audit and Payment Service Provider

When selecting a parcel bill audit and payment service provider, consider the following factors:

- Experience: Choose a provider with a proven track record of success in the shipping industry.

- Expertise: Ensure the provider has specialized knowledge in parcel billing and auditing.

- Technology: Opt for providers that utilize advanced technology to automate auditing and payment processes.

- Flexibility: Select a provider capable of customizing their services to meet your specific needs.

- Cost: Understand the provider's pricing structure and how they charge for their services.

A Step-by-Step Guide to Conducting a Parcel Bill Audit

If you prefer to conduct a parcel bill audit in-house, follow this step-by-step guide:

- Collect All Carrier Invoices: Gather all shipping invoices from your carriers.

- Review Each Invoice for Accuracy: Check for billing errors, surcharges, and discrepancies.

- Identify Areas for Improvement: Look for opportunities in carrier selection or shipping routes.

- Develop an Improvement Plan: Create a plan to address identified areas.

- Implement and Monitor: Execute your plan and monitor shipping data to ensure cost savings.

Common Errors in Parcel Billing and How to Avoid Them

Common errors in parcel billing include:

- Billing errors from carriers

- Incorrect package dimensions or weights

- Missing or incorrect reference numbers

- Incorrect shipping addresses

To avoid these errors, businesses can:

- Double-Check Shipping Data: Ensure all shipping information is accurate before dispatching packages.

- Monitor Carrier Bills: Regularly review carrier bills for errors and discrepancies.

- Track Package Deliveries: Confirm that packages are delivered to the correct recipients.

- Utilize Advanced Shipping Software: Implement technology like barcode scanners and automated shipping software to improve accuracy.

Best Practices for Managing Parcel Billing Data and Invoices

To effectively manage parcel billing data and invoices, businesses should:

- Automate Invoicing and Payments: Use software to streamline these processes.

- Create a Centralized System: Manage all shipping data and invoices in a single system.

- Regularly Review Shipping Data: Identify areas for improvement through continuous analysis.

- Track and Reconcile Carrier Bills: Ensure all bills are accurate and discrepancies are addressed promptly.

Integrating Parcel Bill Audit with Your Overall Supply Chain Management Strategy

Integrating parcel bill audit and payment services with your overall supply chain management strategy ensures a holistic approach to managing shipping processes. This integration focuses on optimizing efficiency and reducing costs across the entire supply chain.

Strategies for integration include:

- Negotiate Better Rates and Improve Service Levels: Collaborate with carriers to secure favorable terms.

- Automate Shipping Processes: Enhance accuracy and efficiency through automation.

- Utilize Data Analysis: Identify inefficiencies and improvement areas through comprehensive data analysis.

- Regularly Review and Audit Shipping Data: Ensure ongoing accuracy and optimization of shipping processes.

How Technology is Revolutionizing Parcel Bill Audit and Payment Services

Technology is increasingly transforming parcel bill audit and payment services. Providers are adopting advanced software and analytics tools to automate auditing and payment processes, enhancing accuracy and efficiency.

Key technologies in the industry include:

- Data Analytics Tools: Identify areas for improvement through detailed data analysis.

- Artificial Intelligence and Machine Learning: Automate auditing processes and improve accuracy.

- Cloud Computing: Enhance accessibility and scalability of services.

- API Integrations: Connect with other supply chain management systems for seamless operations.

Case Studies: Successful Implementation of Parcel Bill Audit and Payment Services in Various Industries

Real-world case studies illustrate the benefits of parcel bill audit and payment services:

- A manufacturing company used parcel bill audit and payment services to identify billing errors and negotiate better rates, resulting in a 15% cost savings.

- A retailer consolidated carrier invoices through parcel bill payment services, freeing up valuable time and resources to focus on customer service and marketing.

- A healthcare provider leveraged parcel bill audit services to identify opportunities for using less expensive carriers and optimizing shipping routes, achieving a 20% cost savings.

Future Trends in the Parcel Bill Audit and Payment Service Industry

The parcel bill audit and payment service industry is continuously evolving, with emerging technologies and trends shaping its future. Key trends to watch include:

- Increased Use of Data Analytics and Machine Learning: Further automation of auditing processes and enhanced accuracy.

- Expansion into International Markets: Growth driven by the increasing prevalence of global e-commerce.

- Integration with Other Supply Chain Management Systems: Enhanced coordination with warehouse management and inventory control systems.

- Greater Emphasis on Sustainability: Adoption of eco-friendly shipping practices to meet growing environmental concerns.

Conclusion

Parcel bill audit and payment services are essential for businesses aiming to optimize their shipping processes, reduce costs, and focus on core activities. By outsourcing these tasks to specialized providers, businesses benefit from expert knowledge, advanced technology, and significant cost savings, providing a competitive advantage. Understanding the fundamentals, best practices, and future trends in the industry enables businesses to make informed decisions and stay ahead in the ever-evolving parcel billing landscape.