Understanding FIFO Accounting: An In-Depth Guide

Accurate financial record-keeping is crucial for any business owner. One key aspect of this is the inventory accounting method, which can significantly influence your financial statements and overall profitability. This guide explores the fundamentals of FIFO (First-In, First-Out) Accounting, helping you determine if it’s the right choice for your business.

What is FIFO Accounting?

FIFO Accounting is an inventory valuation method based on the assumption that the first items purchased or produced are the first ones sold or used. This means when you sell a product, the cost of the oldest inventory item is used rather than the cost of the most recent purchase. For instance, if you run a restaurant and purchase multiple batches of tomatoes at varying prices, FIFO Accounting ensures that the first batch you purchased is the first one used, even if later batches are cheaper.

This method is prevalent in industries where products have a limited shelf life, such as food and beverages or pharmaceuticals. By prioritizing older inventory, businesses can minimize waste and potential losses from expired products. However, during periods of inflation, FIFO Accounting can lead to higher taxable income and lower profits since older, cheaper inventory costs are recognized first.

For a comprehensive overview of FIFO Accounting, refer to resources like the Investopedia FIFO Guide.

Importance of FIFO Accounting

Accurate Financial Reporting

Implementing FIFO Accounting provides a more accurate representation of inventory value and cost of goods sold (COGS). This accuracy is essential for determining your gross profit margin and making informed pricing decisions.

Inflation Management

During inflationary periods, FIFO helps mitigate the impact on financial statements by using the most recent, higher-cost inventory for COGS, preventing an overstatement of profits that can occur with other methods.

Tax Benefits

FIFO Accounting can optimize tax liabilities by matching older, lower-cost inventory with current sales, potentially reducing taxable income. This is particularly beneficial for small businesses aiming to improve their bottom line.

For more insights on inventory management systems, explore the Small Business Administration's financial management resources.

How FIFO Accounting Works

Under FIFO Accounting, the oldest inventory items are recorded as sold first. When calculating COGS, the cost of the earliest purchased or manufactured goods is used. Here's an example to illustrate:

- You purchase 10 widgets at different prices:

- 5 widgets at $10 each

- 3 widgets at $12 each

- 2 widgets at $15 each

- If you sell 4 widgets, the COGS would be:

- First 3 widgets at $10 each

- 4th widget at $12

This approach ensures that the remaining inventory reflects the most recent purchase prices, providing a current valuation of inventory on the balance sheet.

Benefits of FIFO Accounting

- Accurate Inventory Valuation: Reflects the latest costs in inventory balances.

- Higher Profits During Inflation: Older, cheaper inventory is used first, increasing reported profits.

- Simplicity: Easy to implement and understand due to its straightforward logic.

Additionally, FIFO can enhance inventory management decisions by providing a clear picture of inventory turnover and helping businesses plan reorder levels effectively.

FIFO vs. LIFO: Key Differences

Last-In, First-Out (LIFO)

LIFO assumes that the most recently purchased items are sold first. During inflation, this results in higher COGS and lower taxable income compared to FIFO. However, LIFO is not permitted under International Financial Reporting Standards (IFRS), limiting its use globally.

Weighted Average Cost (WAC)

WAC calculates the average cost of all inventory items, regardless of purchase date. This method is useful for businesses with large inventories of similar items but may not reflect the actual flow of goods as accurately as FIFO.

Choosing between FIFO, LIFO, and WAC depends on factors like business type, inventory characteristics, and financial goals. Refer to the Accounting Tools comparison of FIFO and LIFO for more details.

Practical Applications of FIFO Accounting

- Grocery Stores: Managing perishable items like fruits and vegetables to minimize spoilage.

- Electronics Retailers: Handling products like laptops and smartphones where technology rapidly evolves.

- Manufacturing: Managing raw materials in industries like chemicals to ensure the oldest materials are used first.

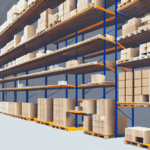

Challenges of Implementing FIFO Accounting

- Cost Determination: Accurately tracking the cost of each inventory item can be complex, especially with bulk purchases.

- Inventory Tracking: Maintaining precise records for large inventories requires robust systems and diligent management.

Employing advanced inventory management software can help overcome these challenges by automating tracking and cost calculations.

Calculating Inventory Value with FIFO

To calculate inventory value using FIFO, follow these steps:

- List all inventory purchases with their respective costs.

- Determine the number of units sold.

- Assign costs to sold units starting with the earliest purchases.

- Calculate the remaining inventory based on the latest purchase costs.

For example, if you have 10 widgets with varying purchase costs and sell 4, you would apply the costs of the first 4 widgets purchased to determine COGS.

Pros and Cons of FIFO Accounting

Pros

- Simplifies inventory management with its logical flow.

- Provides a realistic view of inventory value on financial statements.

- Enhances profitability metrics during periods of rising prices.

Cons

- May result in higher tax liabilities during inflationary periods.

- Requires meticulous record-keeping to track inventory costs accurately.

- Can lead to lower reported profits when prices are falling.

Best Practices for Implementing FIFO Accounting

- Consistent Tracking: Use reliable inventory management systems to maintain accurate records.

- Staff Training: Educate employees on the importance of FIFO and proper inventory handling.

- Regular Audits: Periodically review inventory records to ensure compliance and accuracy.

Impact of FIFO Accounting on Financial Statements

- Cost of Goods Sold: FIFO increases COGS by using older, typically cheaper inventory costs first.

- Inventory Valuation: Remaining inventory reflects current market prices, providing a realistic asset valuation.

- Profit Margins: Higher profits may be reported during inflationary periods due to lower COGS.

Understanding these impacts helps in making informed financial decisions and strategic planning.

Technological Solutions for FIFO Accounting

Modern technology plays a pivotal role in automating FIFO processes, reducing errors, and saving time. Inventory management software can:

- Track inventory levels in real-time.

- Automatically apply FIFO principles to inventory valuation.

- Generate detailed reports for better financial analysis.

Popular solutions include QuickBooks Inventory Management and NetStock, which offer robust FIFO integration.

Adapting FIFO to Changing Market Conditions

Market fluctuations can impact inventory costs and valuation. It's essential to regularly:

- Review inventory costs to reflect current market prices.

- Adjust reorder strategies based on price trends and demand.

- Monitor economic indicators that may influence inventory costs.

Staying proactive ensures that your FIFO Accounting remains accurate and reflective of your business’s financial health.

Conclusion

FIFO Accounting is a widely used inventory valuation method that offers numerous benefits, including accurate financial reporting and effective inventory management. However, it’s essential to consider your business’s specific needs and market conditions when choosing an inventory accounting method. Leveraging technology and adhering to best practices can enhance the effectiveness of FIFO Accounting, ultimately supporting your business’s financial success.