Understanding UPS Package Insurance and Rates in 2023

Are you concerned about potential damages when shipping through UPS? High-volume e-commerce and global shipping demands have made package insurance more important than ever. This article offers an updated, in-depth look at UPS package insurance, covering the types of coverage offered, current rates, how to file a claim, and tips for choosing the best protection for your shipments. Whether you are shipping fragile products or high-value merchandise, understanding UPS coverage options helps you safeguard your investments and maintain peace of mind.

What Is UPS Package Insurance?

An Overview of Coverage

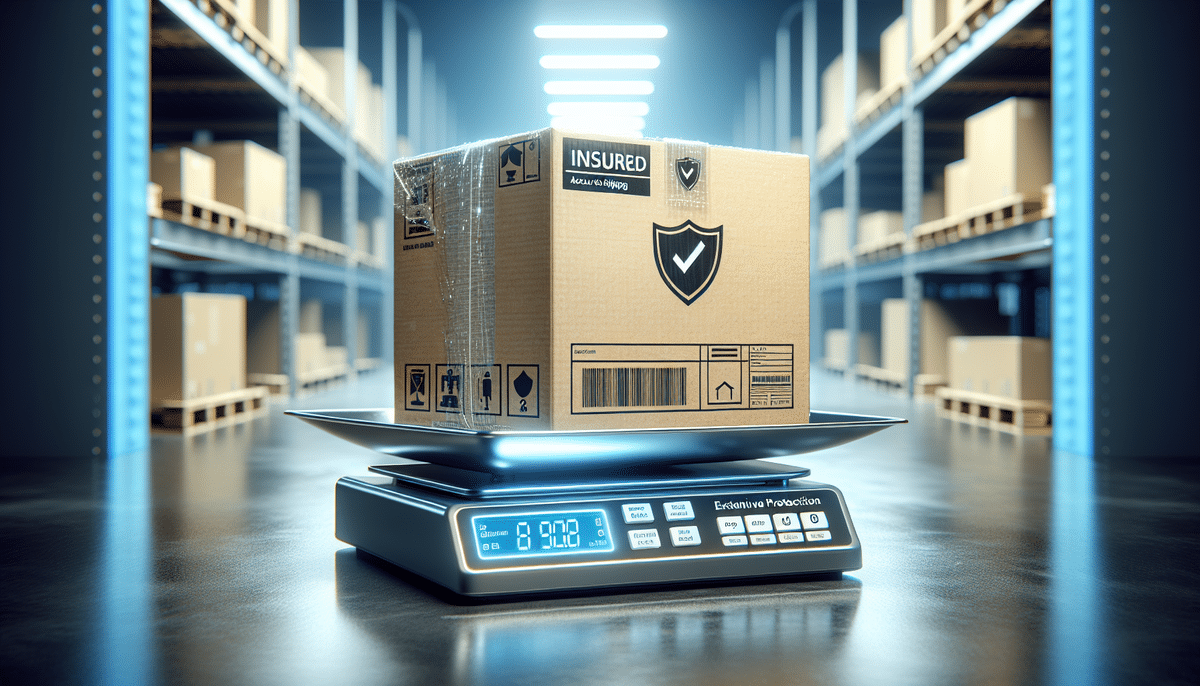

UPS Package Insurance is designed to protect shipments from loss or damage while in transit. Standard UPS services often include a limited declared value (up to USD 100), but you can purchase additional coverage for items exceeding this amount. This extra protection can be crucial when sending expensive electronics, fragile goods, or inventory essential to your business operations.

UPS Capital, a subsidiary of UPS, offers a range of insurance solutions tailored to different shipping needs. By opting for these services, customers can safeguard their packages against unforeseen incidents—an increasingly important consideration in a world where, according to the 2022 Pitney Bowes Parcel Shipping Index, global parcel volume reached 159 billion in 2021.

Key Terminology

Understanding the terms used in UPS insurance policies is essential for making informed decisions:

- Declared Value: The monetary worth assigned to a shipment, which influences insurance costs.

- Cargo: Materials or goods transported for commercial or personal use.

- Theft: The risk of packages being stolen while in transit.

Familiarizing yourself with these concepts ensures you accurately assess the coverage you need, especially if you regularly ship high-value or fragile products.

Industry Insight: Why Package Insurance Matters

Online shopping continues to rise, and carriers like UPS ship millions of packages daily. As of mid-2023, UPS reports handling an average of over 20 million packages per day. With such heavy volume, the potential for loss or damage can grow, making insurance an essential safeguard for both businesses and individuals.

Factors Influencing UPS Package Insurance Rates

Value and Nature of Your Shipment

The most significant factor affecting UPS insurance costs is the declared value of your shipment. Coverage rates typically increase in proportion to the package’s total declared value. Additional considerations include the nature of the goods—fragile or high-risk shipments often require higher coverage due to the possibility of breakage or theft.

Destination and Regional Risks

Insurance rates can also vary depending on shipping distance and the destination’s risk factors. International shipments may incur higher fees if they involve multiple transit points or customs requirements. Similarly, areas prone to severe weather or theft can add extra costs to your coverage.

Comparisons With Competitors

UPS insurance rates are generally competitive, though some carriers may advertise lower premiums. It is crucial, however, to weigh cost against coverage comprehensiveness. A slightly higher rate might prove worthwhile if you benefit from a simpler claim process or more extensive protection. Evaluating potential downtime, lost revenue, and customer dissatisfaction can help shape your decision on which carrier’s insurance best meets your needs.

Available Coverage Options

Basic vs. Full-Value Protection

UPS typically covers declared values up to USD 100 at no additional charge. For items exceeding this threshold, you can purchase incremental coverage that scales with the declared value. As of 2023, rates often start at approximately USD 1.05 for each additional USD 100 of coverage, but they may vary. Always confirm current rates via the official UPS service guide.

Optional Add-Ons and Enhancements

Shippers who regularly send valuable or fragile items can opt for specialized coverage such as InsureShield, customized for high-value shipments. UPS also allows add-ons covering specific risks (e.g., theft protection or coverage for dangerous goods), though these might come with higher premiums. Understanding each optional add-on ensures you pay only for the coverage that truly benefits your operations.

Navigating the UPS Claims Process

Steps to File a Claim

If your shipment is lost or damaged, begin by reporting the issue promptly to UPS. Assemble evidence such as photos of the damage, the original invoice, and the package’s tracking number. From there, file your claim via the UPS online claims portal. Maintaining good communication and providing additional details as requested will help expedite the process.

Common Reasons for Claim Denials

Claim denials typically stem from inadequate documentation or shipment of prohibited or improperly packaged goods. Missing proof of the package’s declared value or neglecting to follow UPS guidelines for restricted or dangerous goods could invalidate coverage. Before shipping, review UPS policies to ensure compliance and prevent potential claim issues.

Frequently Asked Questions

What Is Covered by UPS Insurance?

UPS Package Insurance generally covers damage or loss that occurs while your shipment is in UPS’s care. Typical scenarios include breakage of fragile goods, theft, or complete shipment loss. However, certain restricted or prohibited items may not qualify for protection, so it is important to check UPS guidelines for eligibility.

Can Individuals Purchase Coverage?

Individuals, not just businesses, can purchase UPS insurance for their parcels. Whether you’re sending a valuable gift or personal belongings, you can add declared value coverage during the shipping process online or at a retail UPS location, ensuring peace of mind for high-value shipments.

How Does the Claims Process Work?

The claims process starts with providing proof of shipment and evidence of damage or loss, including photos, invoices, and package tracking details. You’ll then complete a claim form via the UPS portal. Keep track of your claim’s status, respond promptly to any requests for more information, and maintain good records until the matter is resolved.

Key Tips for Selecting UPS Package Insurance

Assessing Shipment Value Accurately

Determining an item’s true worth is crucial. Factor in the replacement cost, sales value, and any business-critical attributes (like time-sensitive deliveries or specialized components). This assessment helps avoid both over-insuring and under-insuring.

Evaluating Potential Risks

Consider weak points in your shipping process, such as poor packaging or destinations prone to theft or severe weather. Using adequate cushioning (bubble wrap, foam, etc.) and following UPS packaging guidelines can reduce risk and aid in claim approvals should damage occur.

Reviewing Past Shipping Experiences

If you’ve experienced lost or damaged packages in the past, study those incidents to identify patterns. You may discover that specific routes, products, or packaging techniques are more susceptible to damage, making additional coverage a sensible investment.

Conclusion

UPS Package Insurance offers a flexible and valuable way to protect your shipments from loss or damage. By understanding coverage levels, rate factors, and the claims process, you can customize a strategy that fits both your budget and your peace-of-mind requirements. Whether you’re a business sending constant cargo or an individual shipping a single high-value parcel, leveraging UPS Package Insurance effectively can help safeguard your items and streamline your overall logistics experience.