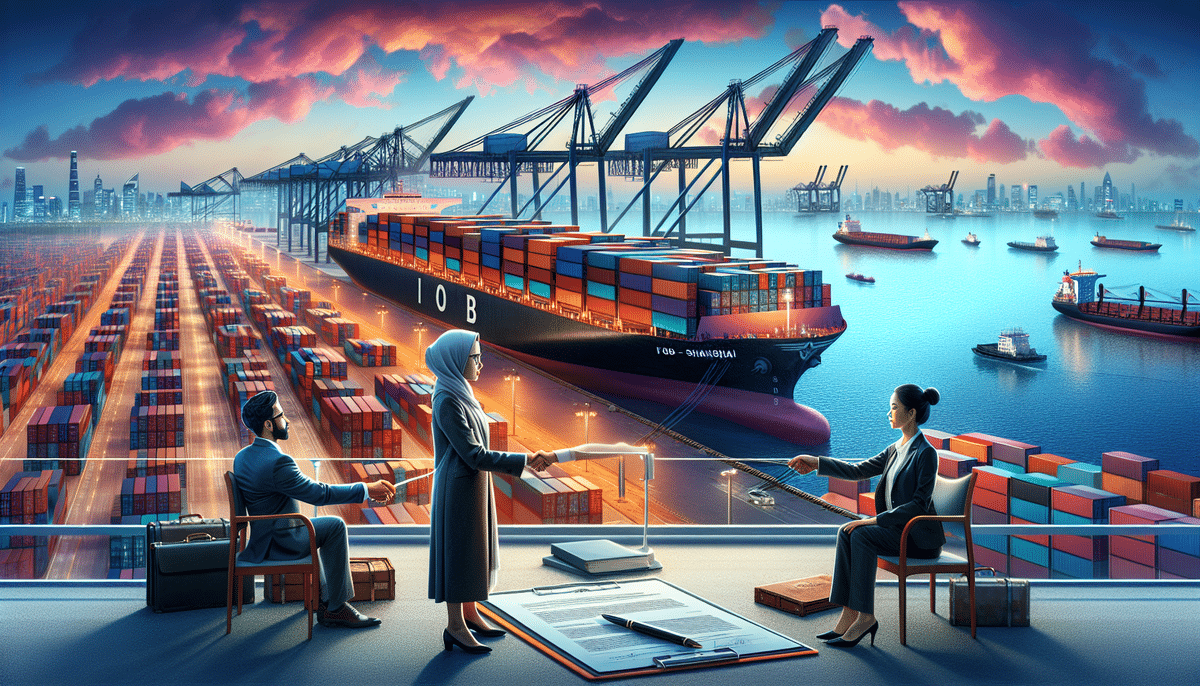

What Is FOB (Free on Board) and How Does It Affect International Trade?

In international trade, the term FOB or “Free on Board” refers to a shipping agreement between the buyer and seller, indicating who will bear the costs and take responsibility for goods during transit. The FOB shipping term is commonly used in ocean freight and international trade transactions, and its proper use and understanding are essential for businesses that engage in cross-border commerce. In this article, we will explore the basics of FOB shipping and its implications for global trade.

Understanding the Basics of FOB in International Trade

At its core, FOB is an agreement between the seller and buyer that specifies where the responsibility for shipment and risk of loss or damage is transferred. When a seller uses FOB, they agree to deliver the goods to a specific port or location and cover the shipping costs to get the goods onto the vessel. Once the goods have been loaded onto the vessel, the responsibility for the shipment transfers to the buyer, who then bears the risk of loss or damage for the duration of the voyage.

FOB can be used for both domestic shipments and international trade. However, it is most commonly used for international maritime trade, where the seller is responsible for getting the products onto the ship at the port of origin. Usually, FOB is followed by an indication of the port of origin (e.g., FOB Shanghai).

It is important to note that FOB only covers the cost of getting the goods onto the vessel and does not include any costs associated with unloading the goods at the port of destination. These costs, including customs fees and taxes, are the responsibility of the buyer. Therefore, it is crucial for both parties to clearly define their responsibilities and obligations in the FOB agreement to avoid any misunderstandings or disputes.

Another important aspect of FOB is the documentation required for the shipment. The seller must provide the buyer with a bill of lading, which is a legal document that serves as proof of ownership of the goods and outlines the terms of the shipment. The bill of lading must include details such as the name of the vessel, the port of loading and discharge, and the quantity and description of the goods being shipped. Without a proper bill of lading, the buyer may encounter difficulties in claiming ownership of the goods or clearing them through customs.

Why FOB is an Important Term in Logistics and Shipping

In logistics and shipping, FOB is a critical term that determines who bears responsibility for the goods during transit. If a seller uses FOB shipping terms, they can transfer the risk of loss or damage of the goods to the buyer once the goods have been loaded onto the transport vessel. This agreement reduces the seller's liability for any potential damages, losses, or delays that may occur during transit.

At the same time, FOB has become an important logistics term because it helps determine the shipping cost. Depending on the shipping terms agreed upon, the buyer may be responsible for additional costs, including port handling fees, export costs, customs clearance fees, insurance, and other charges. This means that shipping costs can vary significantly depending on the shipping terms agreed to by both the buyer and seller.

- Port handling fees

- Export costs

- Customs clearance fees

- Insurance

- Other charges

How FOB Impacts Import and Export Costs

FOB arrangements can have a significant impact on the import/export costs for businesses involved in cross-border trade. For example, if the seller is responsible for FOB shipping, they bear the cost until the goods are loaded onto the vessel. However, if the buyer assumes the FOB shipping terms, they are liable for all of the costs associated with loading the goods onto the vessel, including those relating to storage, handling, and transfer.

It is essential to note that FOB shipping terms do not include the cost of insurance. The buyer and seller must agree on additional insurance coverage separate from the FOB terms to determine who is responsible for insuring the goods during transport.

According to the International Chamber of Commerce (ICC), understanding these costs can help businesses make informed decisions to optimize their supply chain and minimize expenses.

Advantages and Disadvantages of Using FOB for International Trade

The FOB shipping arrangement has its advantages and disadvantages for businesses.

Advantages

- Reduced Liability for Sellers: Sellers can transfer the risk of loss or damage to the buyer once the goods are loaded onto the vessel.

- Cost Control: Sellers may access better freight rates by handling the shipping process.

- Efficient for Perishable Goods: Ideal for shipping perishable or time-sensitive goods, such as food or pharmaceuticals, requiring expedited shipping.

Disadvantages

- Additional Costs for Buyers: Buyers may incur extra costs like port handling fees, export charges, and insurance.

- Risk of Disputes: Misunderstandings about responsibilities can lead to disputes between buyer and seller.

- Dependence on Seller’s Efficiency: Buyers rely on the seller to handle initial shipping efficiently.

Thus, while FOB offers benefits, businesses must carefully consider these factors to ensure it aligns with their operational and financial strategies.

Risks Associated with FOB Shipping

The FOB shipping arrangement exposes both the buyer and seller to various risks.

For Sellers:

- Non-Payment or Refusal of Goods: The buyer may refuse to pay for goods or take delivery upon arrival at the destination port, leading to financial losses.

For Buyers:

- Receiving Inferior Goods: Buyers risk paying for and receiving inferior or faulty goods, as the seller is only responsible for delivery to the port of origin.

- Damage or Loss During Transit: Goods may be damaged or lost due to unforeseen circumstances like adverse weather conditions or accidents. In such cases, the seller may deny responsibility, leaving the buyer at a loss.

To mitigate these risks, both parties should establish clear terms and consider obtaining comprehensive insurance coverage.

How to Negotiate Favorable FOB Terms for Your Business

When negotiating an FOB agreement, businesses need to understand the costs and risks associated with such a contract. Here are key factors to consider:

- Final Destination Costs: Consider the costs associated with transporting goods from the port of destination to the final destination.

- Insurance Coverage: Determine the level of insurance required and who will secure it. Consulting with specialized insurance providers can ensure adequate coverage.

- Payment Terms: Carefully negotiate payment terms and settlement requirements to ensure prompt payment for goods and services.

Additionally, leveraging the expertise of freight forwarders can provide valuable insights and assistance in crafting favorable FOB terms.

Understanding Different Types of FOB Contracts and Their Implications

There are several types of FOB contracts used in international trade, each with its specific implications for buyers and sellers.

FOB Destination

In this type of contract, the seller is responsible for delivering the goods to the port of destination and bears all costs associated with getting the goods to the destination port. This type of contract is advantageous for buyers who are purchasing goods from suppliers unfamiliar with certain ports of destination.

FOB Shipping Point

In this type of contract, the seller is responsible for getting the goods onto the vessel and bears all costs associated with getting the goods to the port of origin. This type of contract can be advantageous for buyers who have a good understanding of the logistics and shipping requirements for specific ports of origin.

Common Misconceptions about FOB in International Trade

There are several misconceptions about FOB in international trade:

- All-Inclusive Shipping Costs: A common misconception is that FOB terms cover all shipping and handling fees when, in fact, they only cover the cost of getting the goods loaded onto the vessel.

- Included Insurance Coverage: Another misconception is that FOB terms include insurance coverage for goods during transit. However, FOB shipping terms do not include insurance coverage, and it is the responsibility of the buyer and seller to agree upon insurance coverage separately.

Understanding these distinctions is crucial for avoiding potential misunderstandings and ensuring smooth transactions.

FOB vs. CIF: Which Shipping Term is Right for Your Business?

FOB is one of several shipping terms used in international trade, including CIF or Cost, Insurance, and Freight. The CIF contract specifies that the seller must bear all costs associated with getting the goods to the port of destination, including loading costs and insurance. CIF can be a more expensive option for buyers compared to FOB, as it includes insurance coverage for goods during transit.

Businesses that are considering FOB vs. CIF contracts must carefully weigh the advantages and disadvantages of each shipping term, bearing in mind the costs, risks, and insurance requirements associated with each.

- FOB: Offers more control and potentially lower costs for buyers but requires them to handle more aspects of the shipping process.

- CIF: Provides comprehensive coverage, including insurance, but at a higher cost.

Choosing the right term depends on the specific needs and capabilities of your business.

How to Ensure Compliance with FOB Regulations and Standards

FOB contracts and regulations vary by country and transport mode. It is essential for businesses engaged in international trade to remain up-to-date with FOB regulations and standards to ensure compliance.

Entities involved in FOB transactions must consider:

- Vessel capacity

- Loading and unloading requirements

- Port regulations

- Level of insurance coverage required

To minimize risks associated with FOB shipments, it may be necessary to involve specialized freight forwarders who can navigate the complexities of international shipping and ensure compliance with all relevant regulations.

The Role of Freight Forwarders in FOB Shipping

Freight forwarders play an essential role in ensuring the smooth and timely delivery of goods, especially in FOB shipments. Freight forwarders act as intermediaries between the buyer and seller, handling all the logistics and documentation necessary to ensure smooth and efficient transport.

Freight forwarders can provide services such as:

- Packing

- Loading

- Customs clearance

- Arranging for insurance and transportation

They can also assist in providing advice on the most appropriate FOB shipping terms for specific transactions, ensuring that both parties understand their obligations and the associated costs.

Case Study: Successful Implementation of FOB in International Trade

One successful implementation of FOB in international trade is the partnership between a manufacturer in China and a retailer in the United States. The manufacturer agreed to deliver the goods FOB Shanghai, with the retailer responsible for all costs and liabilities after delivery to the port of origin. The retailer also negotiated additional insurance coverage to cover the risks associated with transport from port to final destination.

The partnership proved successful, allowing both parties to maximize profits while minimizing risk through proper FOB terms. This case illustrates how clear agreements and comprehensive insurance can facilitate smooth international transactions.

Future Trends and Developments in the Use of FOB in Global Commerce

The use of FOB in international trade is expected to continue to grow in the coming years, as businesses seek to optimize their supply chain and minimize costs. Technological advancements, such as the use of blockchain technology, are also expected to play a role in improving the efficiency and security of FOB transactions.

According to a report by ShipScience, the integration of blockchain can enhance transparency and traceability in shipping, reducing fraud and errors.

However, businesses must remain cautious in their use of FOB shipping terms, carefully considering the costs, risks, and insurance requirements associated with such contracts. By properly understanding the implications of FOB, businesses can make informed decisions that support their global trade objectives while minimizing risk and maximizing returns.